Week In Review: The Reverse Cliff Effect. 25 June 2021

Week In Review: The Reverse Cliff Effect

US equity indexes were up on the week: DJIA 3.4%, S&P 500 2.7%, NASDAQ 2.4%. Equity indexes recovered from last week’s pullback caused by the FOMC meeting.

We have written a series of articles on Digital Currencies, both for clients and for the public on Substack. This week, Head of Asia Pacific Grant Wilson, continued his series for clients with the note Digital currencies (VI): DeFi – Stablecoins & algorithmic interest rates. Below are some of Grant’s main points:

“a) This is a complex area, so we are addressing in two parts, that focus on the main innovations that underpin the space, and the associated flows: i) In this note we highlight algorithmically determined interest rates, and the role they have played in supporting flows to stablecoins pegged to the USD (whether custodial or collateralized); ii) Ahead, we will address decentralized exchanges (DEXs), and specifically the key breakthrough of Constant Function Market Makers (CFMMs).

b) The basic point is that interest rates, both for borrowers and lenders, can now be set entirely independent of a central bank, or market makers for that matter. This is a paradigmatic shift.

c) Algorithmic interest rates are one of two key breakthroughs that have underpinned the emergence of the DeFi sector over the past year. While we have been critical of various aspects of crypto, it would be churlish not to recognize the ingenuity on display here, along with the rapid pace of innovation.

We expect to hear of further unease from global regulators and from tax authorities in this area. DeFi is not yet mature enough, or at the scale, to disrupt traditional financial intermediaries. But the potential is there, hence the debate will continue.”

Chart: StableCoin Yield. Utilization Rate vs. Borrowing Rate

Ahead Next Week: Select economic releases. Next week sees a rate meeting from Riksbank; a number of trade balance releases and manufacturing PMIs, along with US Payrolls for June and Eurozone CPI for June.

Monday, June 28:HK Trade Balance (May), Mexico Trade Balance (May), ECB’s de Guindos speaks at Euro Finance Summit,Fed’s Quarles speaks on Central Bank Digital Currency.

Tuesday, June 29: UK Nationwide HPI (Jun), Sweden Trade Balance (May), ECB’s Lagarde speaks at Brussels Economic Forum, Germany CPI (Jun), RBA Gov Lowe speaks, China Mfg/Non-mfg PMIs (Jun),

Wednesday, June 30: UK Current Account (Q1), BoE’s Haldane speaks on changes in monetary policy, FS policy and central banks comms, Turkey Trade Balance (May), EZ CPI (Jun), South Africa Trade Balance (May), US ADP Non-Farm Employment (Jun), Canada GDP (Apr), Japan Tankan (Q2), Korea Trade Balance (Jun), Australia Trade Balance (May), China Caixin Mfg PMI (Jun).

Thursday, July 1: HK/Canada Holiday, Switzerland CPI (Jun), Riksbank monetary policy decision, BoE’s Bailey Speech at the Mansion House Financial & Professional Services Event, Germany/EZ/UK/Mexico Mfg PMIs (Jun), US ISM Manufacturing PMI (Jun), Brazil Trade Balance (Jun), Korea CPI (Jun).

Friday, July 2: US Payrolls (Jun), US/Canada Trade Balance May.

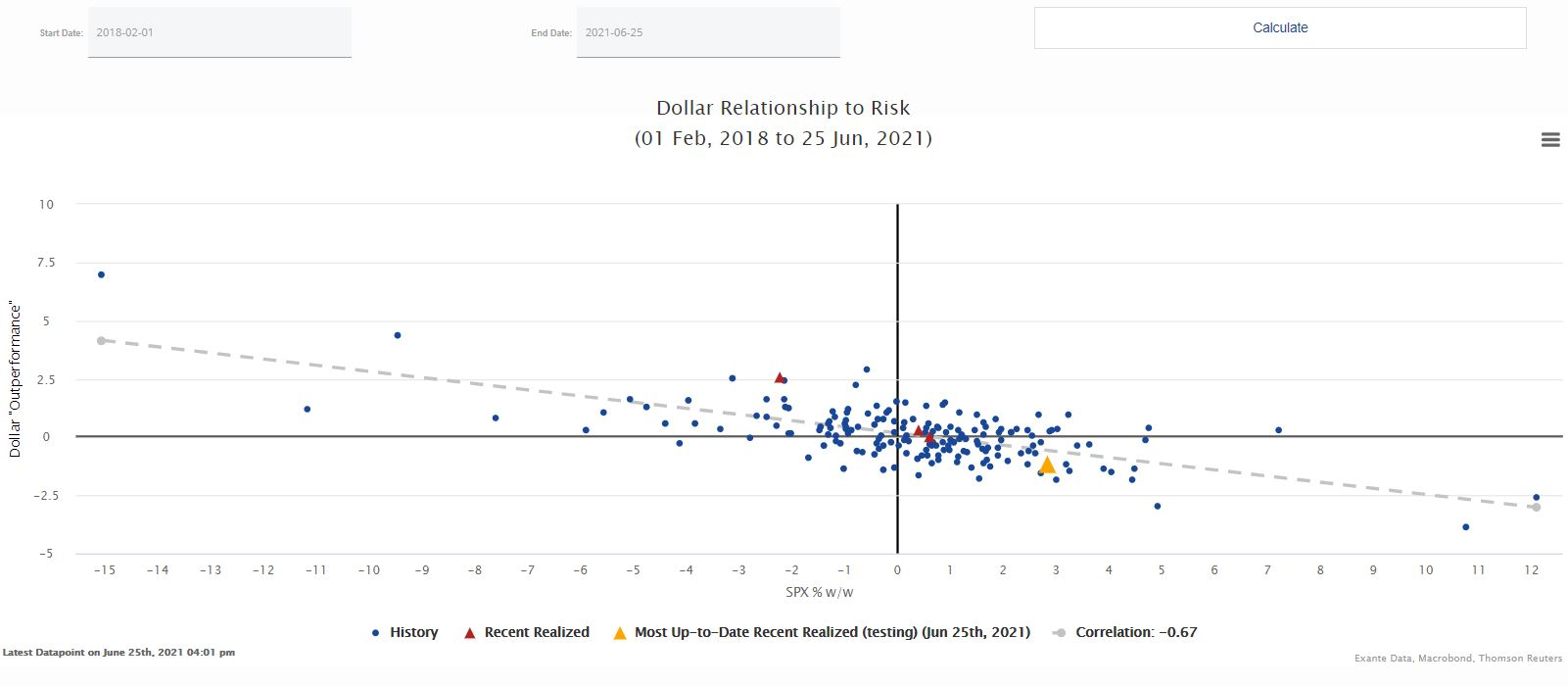

USD Comment

USD returned to underperformance this week in the wake of last week’s rally. It appears as though some of the move is a recovery from position washouts. However strong equity performance also signaled a weak Dollar (chart below). The DXY Index was in a narrow range: 92.35-91.51. EURUSD ranged 1.1850-1.1973. Of the FX returns vs. USD that we follow in our heatmap, MXN was the strongest vs. USD on the week, as Banxico hiked its policy rate by 25bps. The low in USDMXN was 19.71. JPY was the weakest vs. USD as risk seeking sentiment was strong. USDJPY high was 111.08.

Chart: USD Relationship to Risk

Covid-19 Update: The Reverse Cliff Effect

The Week In Review note gives readers a glimpse of what we do at Exante Data. We want to communicate with the public, and stay in touch with our global contacts. But we also want to keep our proprietary content exclusive for our clients. This week, we make an exception, on an important topic, both for global health and global markets. Over the last two months, we have been doing detailed analysis around global vaccine supply, and how it will be increasingly shared around the world. We call this dynamic the “Reverse Cliff Effect”. We have mentioned this a bit in the Week In Review. However, Founder Jens Nordvig published a Public Letter: The Reverse Cliff Effect for Vaccine Supply Will Allow Global Reopening, which includes details and main conclusions. Below is an excerpt – see the Public Letter for full details.

- As of end-May of 2021, total vaccine production in the US and the EU had reached 647 million doses, and exports – defined as production in excess of domestic administrations – were 106 million doses.

- In June-Dec of 2021, vaccine production in the US and the EU is set to spike to 5.8 billion doses, and exports are projected to hit 4.9 billion doses!

- Exports are set to increase by huge factor in June-December vs. the end-May total. If we scale by month, excess production in the EU and US are set to increase over 30 times! From a monthly average just above 20 million during January-May to around 700 million per month during June-December (on average).

Chart: Vaccine Excess Production in 2021 (mn doses)

Exante Data Happenings & Media

Founder Jens Nordvig and Senior Advisor Chris Marsh published a Substack on a hot topic: El Salvador’s Bitcoin Gambit. “With limited seigniorage revenue and ongoing BOP pressures, El Salvador’s historic decision to make Bitcoin legal tender reflects macroeconomic fundamentals as much as currency innovation.”

Jens sat down with the Institute for New Economic Thinking earlier this year and spoke about the long-term economic setting we are in, how the COVID shock has reshaped policy, and what he thinks is ahead. You can watch the interview here.

Grant Wilson has a new opinion column out in the Australia Financial Review: Decentralised finance is changing the game.

Tourism Recovery: We recently launched our “Tourism” page on our data and analytics platform. Given the unpredictability of COVID-19 and travel restrictions, as well as the lagged nature of official tourism data, we also use alternative data from Google and on hotel bookings to closely track the return of global travel. To give clients real-time access to this data, we are launching our “Tourism” page. It provides an overview of the state of the industry in key tourist destinations (Mexico, Thailand, Turkey, New Zealand, Malaysia and South Africa).

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, Digital Currency Series, and/or our Covid-19 vaccine rollout tracking and Tourism Recovery tracking — please reach out to us here.