Week In Review: The First. 11 Dec 2020

Week In Review: The First

US equity indexes were lower on the week: DJIA -0.6%, S&P 500 -1.0%, NASDAQ -0.7%. Drawn out negotiations between the Republicans and Democrats on another round of fiscal stimulus, and worse than expected initial jobless claims weighed on sentient.

On Tuesday, December 8th, the UK’s NHS announced a “landmark moment” – Margaret Keenan, 90-years-old, became the first person in the world to receive the Pfizer/BioNTech COVID-19 vaccine. NHS nurse May Parsons was the first in the UK to deliver the vaccine to a patient. UK PM Boris Johnson was present to see some of the first vaccinations given. A statement on his Instagram account said, “We have ordered 40 million doses – enough for 20 million people and we are starting with an initial 800,000 doses, which are arriving in hospitals across the country.” On Friday, post-market close, the US FDA authorized the Pfizer/BioNTech vaccine for emergency use- the first vaccine the US has authorized to fight the pandemic.

Turning to central banks, the ECB’s policy announcement was more-or-less as expected with 9-month PEPP extension and envelope expansion (+EUR500BN to EUR1,850BN through at least end-March 2022), reinvestments through end-2023 at least, 12-month TLTRO expansion at -100bps, no change in rates or APP. The PEPP envelope at EUR1,850BN means the weekly purchase pace could continue unchanged until March 2022, so it could have meant unchanged policy for 15 months.

Senior Advisor Chris Marsh notes that the press conference delivered an unexpected twist since Lagarde made clear PEPP purchases would be flexible to “maintain financing conditions” and the envelope could be increased or not used in full. Chris says, “This institutionalizes yield spread control, and raises the question about what yields are appropriate for peripherals. It means markets can test key levels. As with Japan Yield Curve Control, this is a silent taper but with no clear level for yields.”

Ahead Next Week: Select economic releases: Sunday, Dec 13: NZ Westpac Consumer Sentiment (Q4), Japan Tankan (Q4), Monday, Dec 14: RBA Meeting Minutes, China Fixed Asset Investment (Nov). Tuesday, Dec 15: UK Employment chg (Oct), Norway Trade Balance, Canada Housing Starts (Nov), US TIC data (Oct), NZ Current Account (Q3), Japan Trade Balance (Nov). Wednesday, Dec 16: UK CPI (Nov), German/Eurozone/UK PMIs (Dec), Eurozone Trade Balance (Oct), US Retail Sales (Nov), Canada CPI (Nov), US FOMC Monetary Policy Decision & Press Conference, NZ Q3 GDP, Japan Foreign Investment data, Australia Employment (Nov). Thursday, Dec 17: Norway Monetary Policy Decision, UK Retail Sales (Nov), SNB Monetary Policy Decision, Eurozone Inflation data (Nov), BoE Monetary Policy Decision, US Initial Claims, NZ Trade Balance (Nov), Japan CPI (Nov), BoJ Monetary Policy Decision. Friday, Dec 18: UK Retail Sales (Nov), German IFO (Dec), Eurozone Current Account (Oct), Canada Retail Sales (Oct), US Current Account Q3.

USD Comment

USD was mixed this week. The DXY Index ranged 91.21-90.62, ending the week at 90.98. EURUSD ranged 1.2061-1.2160. GBPUSD was volatile, ranging 1.3477-1.3137. GBP was the weakest G10 currency vs USD this week, hampered by lack of clarity on Brexit. AUD gained the most vs USD in G10 FX, breaking topside 0.7500. Outside of G10, MXN was weaker vs USD – MXN is hampered by seasonality in December (chart).

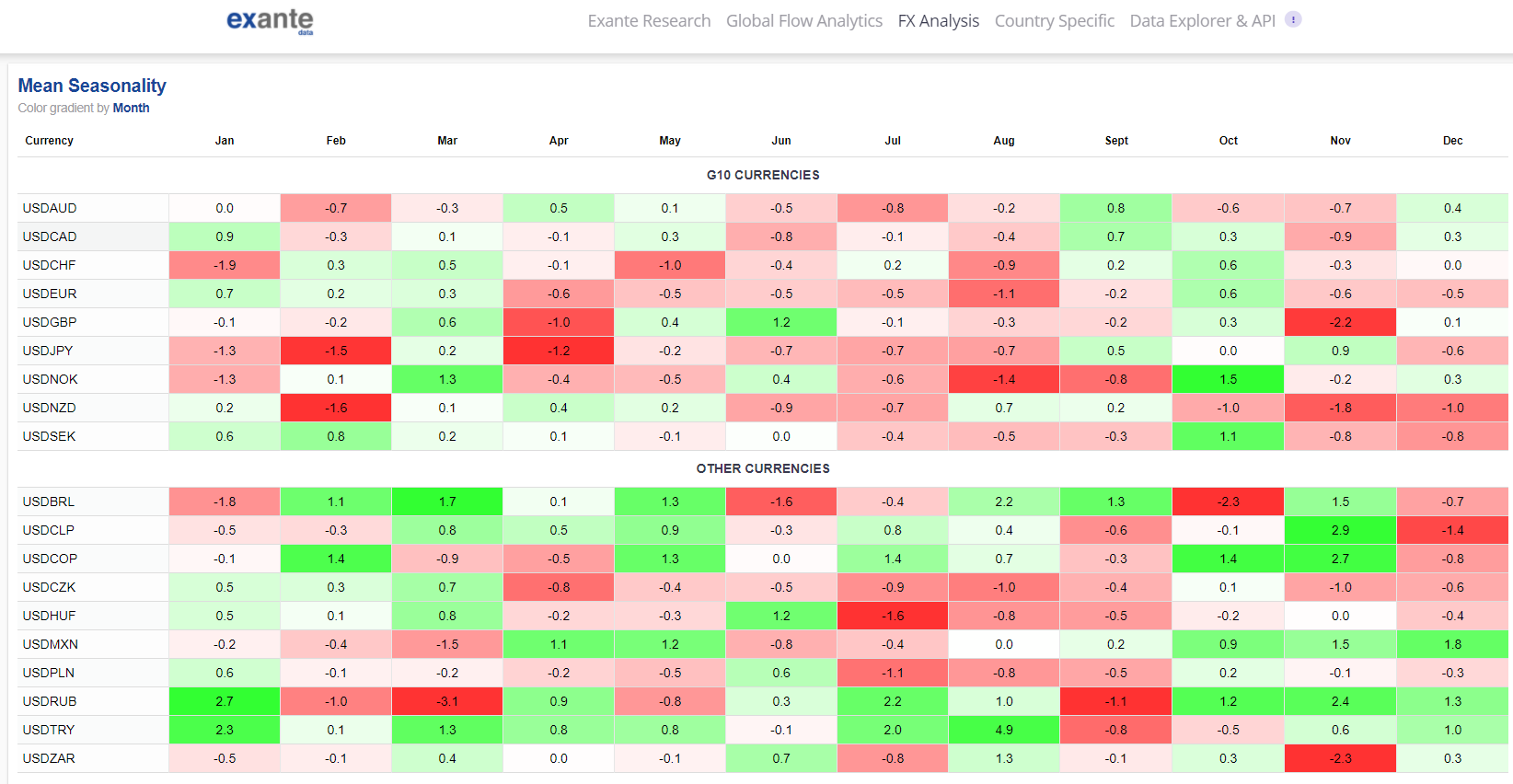

Below is USD seasonality for December from our proprietary FX factor model. USD seasonality is less pronounced this month than last, but there is a fairly clear pattern for LATAM currencies. December seasonality is strong for BRL, COP, and CLP, but not for MXN.

Coronavirus Update

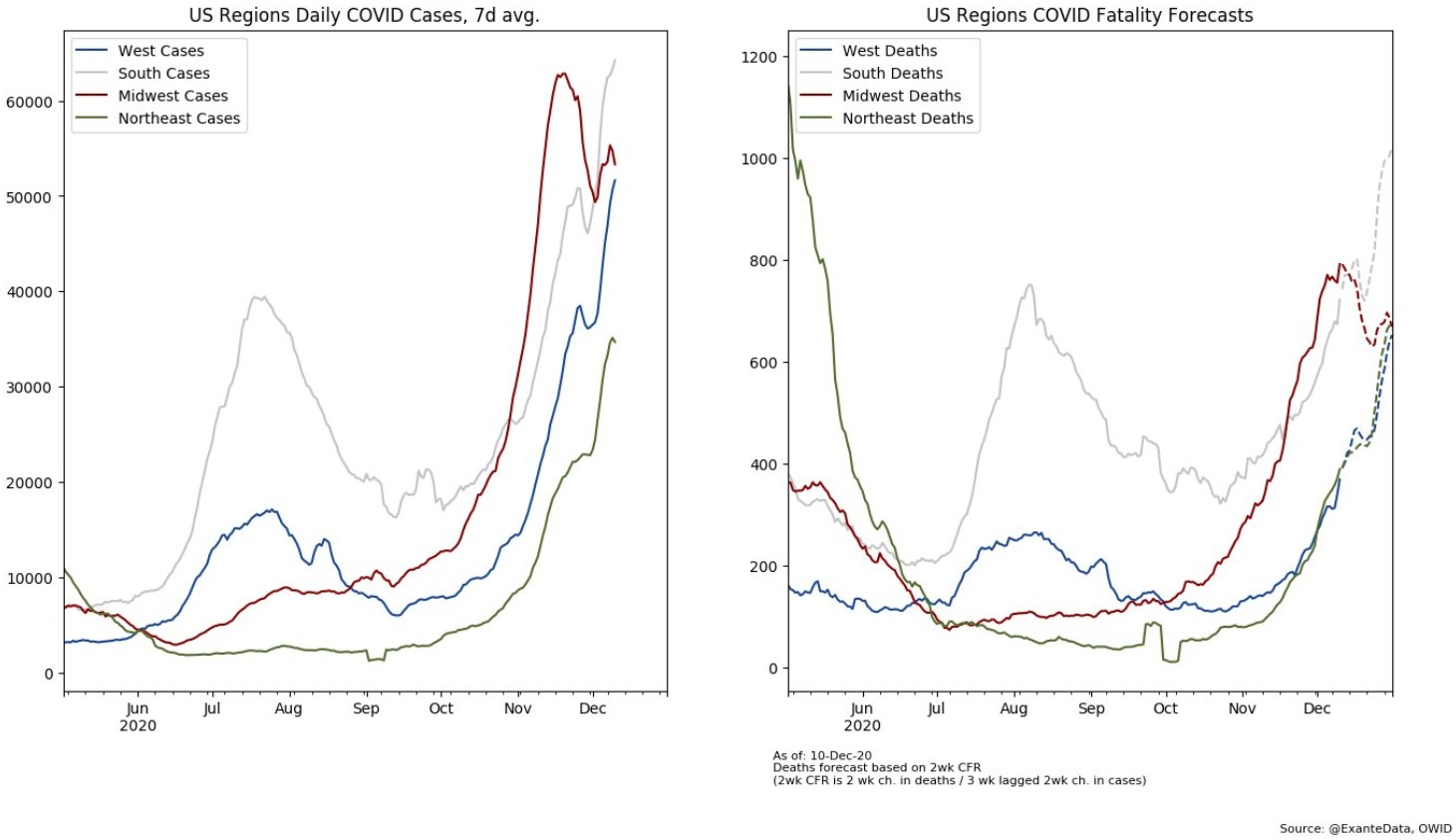

US: December 9 was another grim milestone in the US COVID-19 outbreak – a record number of fatalities were reached. In addition, cases are rising across all regions post the Thanksgiving holiday (chart below). Given rising cases and hospitalizations, we expect daily fatalities to remain above 3000 for the foreseeable future. You can see daily COVID-19 case growth rates (7 day average) for individual US states here.

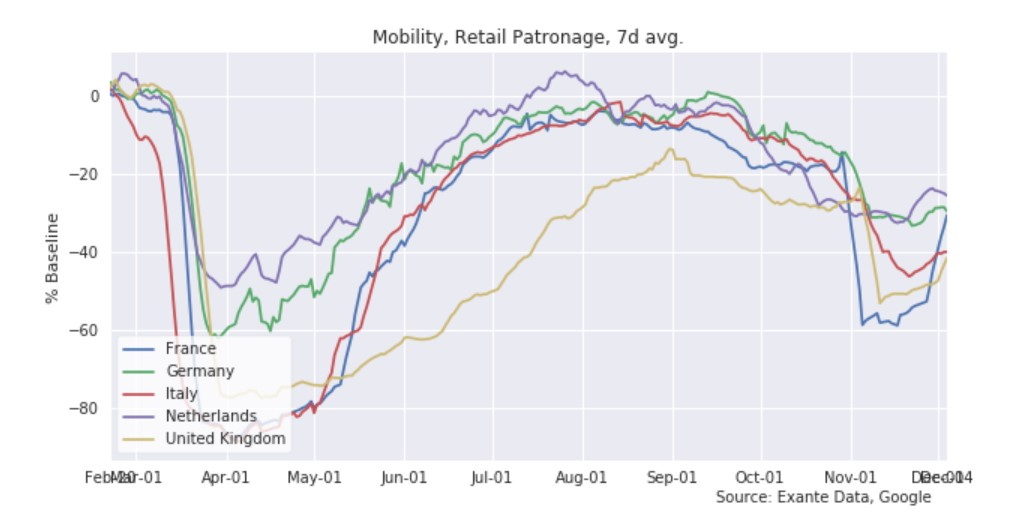

International: After implementing a lockdown lite, Germany has failed to bring down cases as seen in the likes of France, Italy, UK, Netherlands and Belgium. Instead, cases have plateaued at a high level. In response, Merkel appears to be preparing to tighten restrictions and move to a full lockdown over the holiday period. Germany’s decision to move to a full lockdown does raise questions about whether “lockdown lite” can be effective.

The share declines in mobility (chart below) in the UK, France and Italy look to have helped them generate a descent in new cases, and while the Netherlands also appears to have generated a descent with mobility more akin to Germany, cases have begun to rebound there in recent days.

Exante Data Happenings & Media

Our Substack blog – Money: Inside and Out has officially launched! You can subscribe here.

Founder Jens Nordvig explains, “At Exante Data, we have been thinking a lot about how to strike a better balance between bringing some analysis to a broader audience while keeping our investment strategy appropriately restricted. Money: Inside and Out is an attempt to again break free, and deliver views and analysis on topics we care deeply about, without holding back, to the public.” Read Jens’ full Substack mission statement here.

The first blogs are:

The Big Myth about Money and Inflation by Jens. It touches on the conceptual misunderstandings around the link, and how the future may again shake things up, if monetary and fiscal expansion are (aggressively) combined.

Could there be a Eurosystem liquidity crisis? – a three part series by Senior Advisor Chris Marsh.

Money velocity in the United States by Chris Marsh. Its about the academic concept of velocity.

Our Substack is currently free and open to the public – join us and spread the word – as we are looking to have a lot of engagement and debate on these important macroeconomic topics.

Jens was on Bloomberg Surveillance this week. He talks EURGBP outlook on no deal Brexit and implications longer term to UK economy from not having access to the EU services market here. He talks USD medium term view, whether EURUSD at 1.2500 is problematic for ECB, China BoP, and is China intervening here.

If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, and/or Exante Data API — please reach out to us here.