Week In Review: The Dropouts. 16 April 2021

Week In Review: The Dropouts

US equity indexes were higher the week: DJIA +1.2%, S&P 500 +1.5%, NASDAQ +1.1%. Some better than expected economic data propelled US indexes higher this week. The DJIA surpassed 34,000 for the first time.

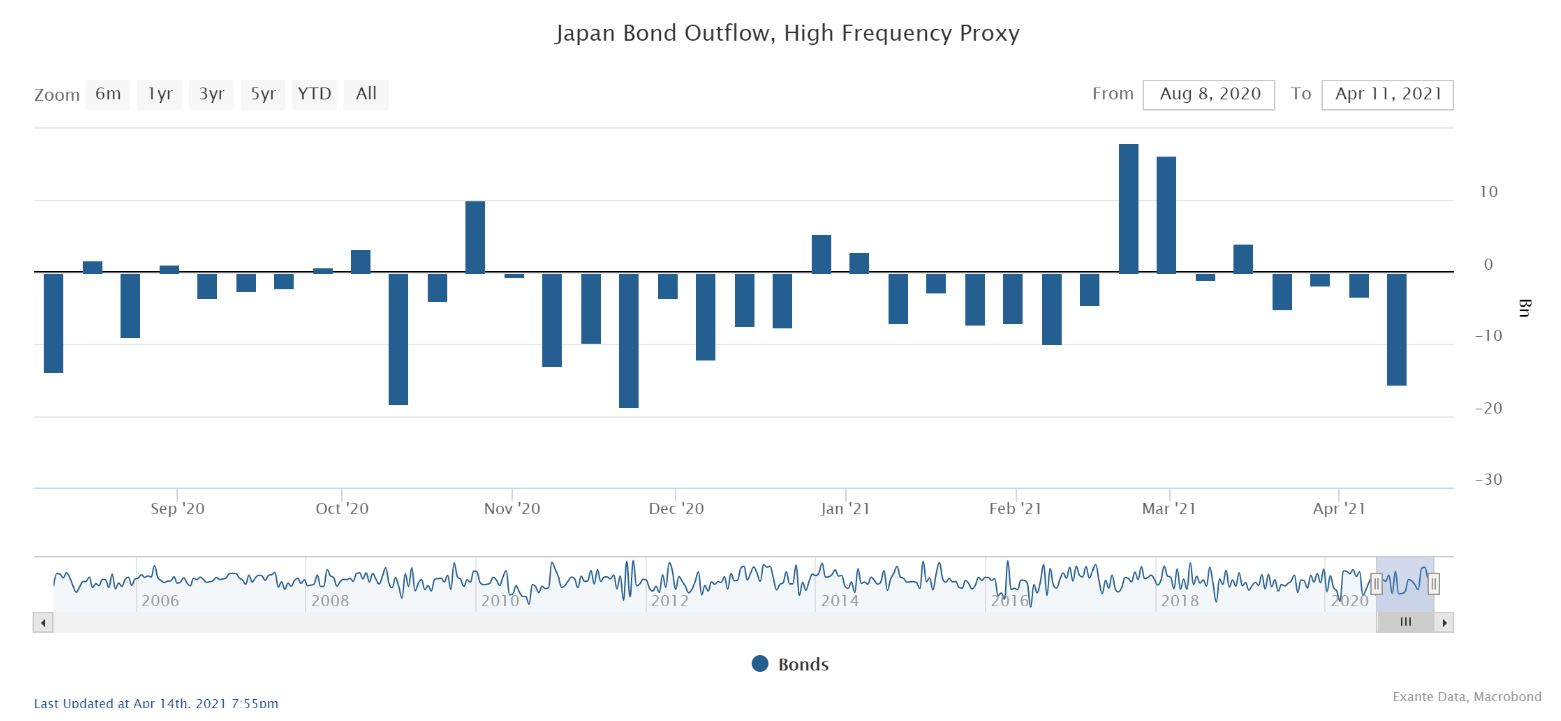

Turning to flows, Japan investors increased their foreign debt purchases. The USD15bn in purchases of foreign debt in the week to April 9, are the largest single-week bond outflow since December (chart). It is possible these flows are hedged (for example if they are from banks). These purchases come at the start of the new fiscal year. We think it makes sense that institutional investors may have suppressed some appetite for foreign bonds in the weeks leading up to fiscal-year end, particularly in February as there was volatility in fixed income. We will monitor this latest data point as a single-week print does not necessarily signal the start of a trend.

USD Comment

The USD was weaker on the week. Though US rates fell relative to most other curves, these shifts do not fully explain the Dollar’s weakness. USD underperformance also exceeded what would be expected given the moderate gains in the S&P this week (chart).

Since last Friday, DXY Index has ranged 92.40-91.49. Despite some better than expected US economic data releases, US 10 year yield was lower on the week, weighing on USD. With the rise in US equities, high beta AUDUSD broke topside 0.7700 and NZDUSD broke topside 0.7100. EURUSD ranged 1.1869-1.1988, strengthening throughout the week, but remaining below 1.2000 resistance. GBPUSD remained in its range since late March of 1.3670-1.3905, stymied as the UK vaccine rollout outperformance is over.

Coronavirus Update

On Tuesday, US federal health authorities recommended that providers temporarily stop administering the Johnson and Johnson (“JNJ”) Covid-19 vaccine due to a potential link to very rare blood clots. According to CNBC reporting, the Advisory Committee on Immunization Practices (“ACIP”) will meet April 23 to discuss recommendations for the JNJ vaccine. So the pause will be at least 10 days. Founder Jens Nordvig notes that is “longer than needed to inform doctors about how to treat the new, rare type of clots, so more is clearly at stake now.”

The Dropouts: There have only been six cases reported that have developed blood clots (all in women age 18-48) after receiving the JNJ vaccine, but the situation feels similar to the AstraZeneca situation in the EU, and could cause issues with approval as well as acceptance going forward. In the April 9 Week In Review, we discussed Exante Data team’s herd immunity model removing the upcoming expected AstraZeneca supply. This week, the Exante Data team, using its proprietary Covid-19 herd immunity model, has conducted scenario analysis for the herd-immunity timetable with both the AstraZeneca and JNJ vaccines dropping out of the supply.

The main conclusion is that the delays could be significant for European countries, pushing herd immunity back by 2-3 months. However, news was recently announced that the Pfizer and Moderna vaccine supply to the EU will be incoming faster than expected. Taking that into account and without the AstraZeneca and JNJ vaccines, herd immunity would still be delayed about 6 weeks for the EU, but this is better than the 2-3 months (the most bearish case) without any pickup in supply from the MRNA producers.

Meanwhile, vaccination milestones have been reached this week – The US reached 200 million vaccine doses administered. In the EU, 100 million vaccine doses have been administered. Take a look at Google’s mobility report – we are seeing the Global GDP-weighted index of Retail & Recreation Patronage at -21.7% vs baseline. Within G4, United States is currently leading while the EU and UK are lagging.

Charts: The pace of administration in the EU and US has moved down marginally, though it remains near a record-high in both economies.

Exante Data Happenings & Media

Founder Jens Nordvig joined Raoul Pal and Real Vision for a deep dive into the global macro outlook. They talked: COVID end-game, Fiscal policy trends and bond market dynamics, New US policy initiatives (tax coordination etc), Potential for ‘New Bretton Woods’ for FX, FX views (dollar, tourism effects, analogies, lack of taper tantrum, US current account). The full interview is here, but you have to be a Real Vision subscriber to view. Clips from the interview are here and here.

We released a new blog giving a brief introduction to Exante Data and the Exante Humans behind the Substack blogs – Money: Inside and Out.

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, our Digital Currency Series, and/or our Covid research — please reach out to us here