Week In Review: October 9, 2020

US equity indexes gained on the week: DJIA +3.3%, S&P 500 +3.8% and NASDAQ rose +4.6%.

This was another headline driven week. US President Trump was released from the hospital on Monday. The VP debate took place on Wednesday between Senator Kamala Harris and VP Mike Pence at which a fly captivated the nation’s attention. President Trump called off the fiscal stimulus negotiations, but then reversed course – wanting a smaller fiscal package and then again calling for a larger one. The FBI thwarted a plot by two militia groups to kidnap Michigan Governor Whitmer. The October 15th Presidential debate went virtual, but then President Trump announced he would not participate, so it was cancelled. (See how betting odds on the US Presidential Election from PredictIt shifted over the week – PredictIt section below).

In the meantime, investors monitored back and forth headlines about the prospect for near-term fiscal stimulus in the US, Europe and UK announced more restrictions aimed at stopping the rising COVID-19 case counts, while the US loosened some. ECB minutes were released.

On ECB Minutes, Senior Advisor, Chris Marsh notes that the ECB’s accounts of the Sept policy meeting paint a picture of a more dovish and pro-active Governing Council in contrast to the press conference. There was clear concern that risks were tilted to the downside and that inflation was still projected below target in 2022. There was a need to keep open the option of more policy action — they are watching incoming data closely, and they should be ready to adjust any of their tools appropriately (meaning rate cuts/TLTRO adjustment as well or instead of as PEPP). Here are some key quotes from the minutes: The balance of risks were still “tilted to the downside. While the NGEU recovery plan was a positive development, uncertainty about the evolution of the ongoing COVID-19 pandemic and the potential materialization of adverse real-financial feedback loops called for vigilance.”

Over the coming months additional information would help to inform the direction of policy. This included tracking the underlying dynamics of the pandemic, developments in negotiations on the post-transition Brexit arrangements and decisions on fiscal plans. “In the prevailing environment of high uncertainty, keeping a steady hand with respect to monetary policy was seen as most appropriate. At the same time, the case was made for keeping a “free hand” in view of the elevated uncertainty, underpinning the need to carefully assess all incoming information, including the euro exchange rate, and to maintain flexibility in taking appropriate policy action if and when needed. Over the coming weeks more data would become available, which would provide improved visibility about how the various forces at play would influence the medium-term inflation outlook. In this regard, the underlying dynamics of the pandemic, developments in negotiations on the post-transition Brexit arrangement, the outcome of the US presidential election and decisions on fiscal plans at the individual country level as well as at the euro area level had to be closely monitored.”

Interested in our weekly central bank balance sheet updates from Chris? You can find them here: ECB Q-end, Bank of Japan.

USD Comment & October Seasonality

With the gains in US equities, the USD remained on its backfoot this week. The DXY Index ranged 93.88 – 93.00 (at the week’s end). The ‘big fix’ for CNY after the Golden Week holiday came in lower than expected. CNH gained on the week. Higher beta NOK, SEK, AUD, and CAD gained. Canada had a strong September employment report. NZD gained less than its commodity FX cohorts due to RBNZ’s dovish tones. Ahead Saturday, October 17 is the NZ General Election. There were equity inflows into Korea this week. Shifting US election probabilities and US equities rising helped MXN gain this week. EURUSD ranged 1.1711- 1.1829. GBP ranged 1.2852-1.3045. October 15 is UK PM’s self-imposed Brexit deadline and Oct 15-16 is a European Council Summit.

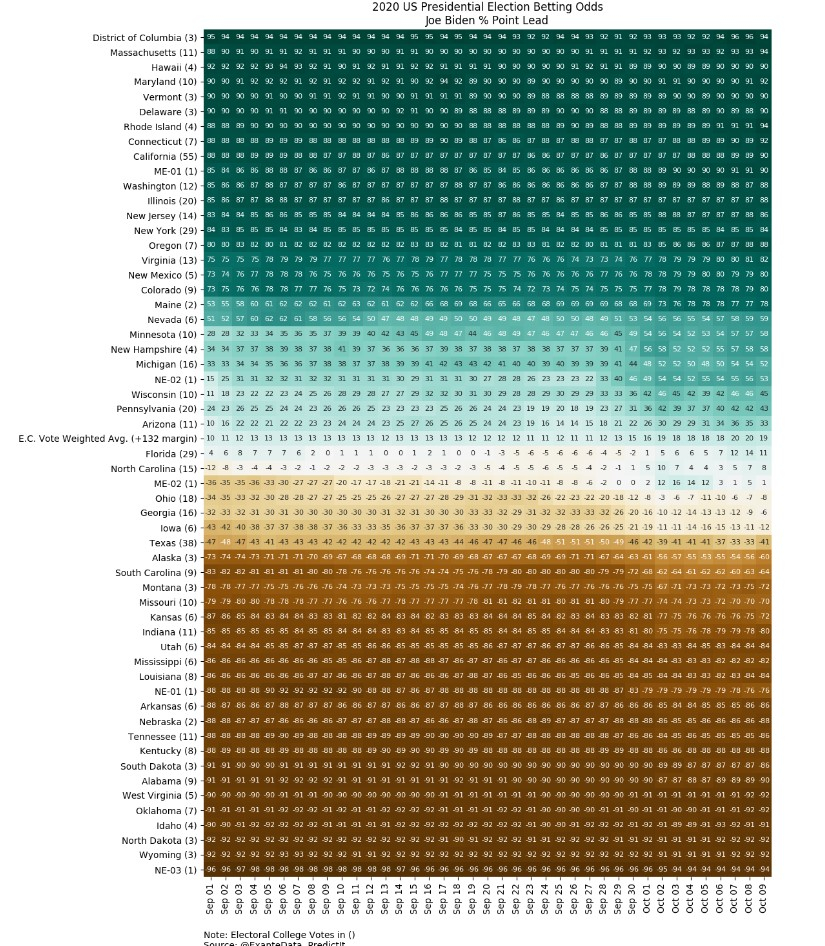

PredictIt Data & US Presidential Election

Our heatmap below for US states shows 2020 US Presidential Election Betting Odds, Biden % point lead daily. Here are some relevant dates for reference to see how events shifted the odds: Friday Oct 2nd, at 12:54am EST, President Trump announced that he tested positive for coronavirus. Monday, October 5 at around 6:45pm EST, President Trump leaves hospital. Tuesday October 6 at 2:48 pm EST, President Trump tweets that he has instructed his representatives to stop fiscal stimulus negotiations. Same day at 10:18pm EST, the President tweets that he is ready to sign a more limited fiscal stimulus package. Wednesday, October 7 at 9pm EST is the Vice Presidential debate. Friday, October 9, President Trump says he will not attend virtual debate on October 15.

PredictIt data, seen on our heatmap, show a kneejerk shift toward Biden on October 2nd that then backed off a bit. October the 6 and 7 see a bit of a shift back towards Biden as the “no fiscal stimulus” stance did not appear to be popular. Now, that later move toward Biden has once again backed off a bit in some states on October 9.

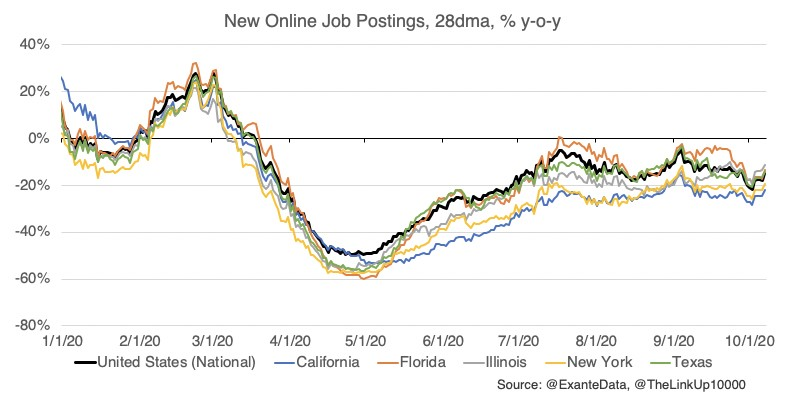

New Online Jobs Postings

Coronavirus Update

International: Trends in Europe are turning mixed. We have pretty clear improvement in Spain, consistent with the lag from policy tightening. But growth is accelerating in the UK (2.6%), the Netherlands (3.1%) and the Czech Republic (4.7%), while France is stabilizing at a high growth of around 2%. We continue to expect key countries to see results of policy tightening by mid-October, but the list of problem countries is growing.

US: Trends remain stable in most US states, with growth rates in the 0.3-1.0% range. But certain Northern states are seeing rising growth, with Montana, Wyoming and North Dakota the clearest examples (now up to 2-3%). Wisconsin stands out for concern, with case growth in the state trending at 1.7% per day and testing hit ratios near 20%. Our heatmap here shows the trend of daily growth in confirmed coronavirus cases among US states, along with the trend of daily testing hit ratios.

Exante Data Product Launches & Happenings

Encore presentation: Jens joined @thalesians recently to talk “Forecasting USD using capital flow data.” In this presentation, Jens demonstrates some of Exante Data’s proprietary charts and analytics – it is a good sneak peak into some of our data and analytical tools available only to clients. You can watch the presentation here.

Founder Jens Nordvig reaches 10k followers on Twitter. In this thread, Jens thanks his followers and gives his thoughts on why Twitter is useful, how he uses it, and insights he has gained in the process. “It has also been a great help to use the ‘robotic feeds’ we now have on @ExanteData. I use them to absorb more information myself, and I push them to @jnordvig when I think there is something especially interesting. It is a way to come up with fresh perspectives, from raw data.”

Bloomberg users – you can view Exante Data tweets on the terminal. We update charts and commentary daily there. Users can type into the blue command line: TWEETS BY EXANTE <GO>. Alternatively, to add to Launchpad: 1. Run SOCI <GO> 2. Type into the orange box Exante 3. Select the handle at the bottom “TWT_EXANTEDATA” 4. Click the white LLP <GO> to Open in Launchpad to view in Launchpad mode 5. To save the search >>> Click Actions in the top red tool bar >> Save Search

For more information and/or to see a demo of our data platform, institutions — please reach out to us here.

Media

Head of Asia Pacific Grant Wilson wrote an opinion column for the Australia Financial Review: The Northern Territory must not lose its voice. “Absent a response from the Morrison government, the Northern Territory is set to lose one of its two seats in the federal parliament at the next election. This would further disenfranchise our Indigenous community.”

Senior Advisor Brad Setser has a new blog out for the Council on Foreign Relations – Record Chinese Bilateral Surpluses With the United States Are Not Mirrored in the U.S. Trade Data. “Is China’s surplus with the United States back at a record level? It depends. In China’s data, China’s exports to the United States and its surplus with the United States are at all-time highs. The United States’ import data, however, shows fewer imports from China than China reports exports—which is interesting, because the norm has long been the other way around.”

To receive our Week In Review every Saturday, sign up here.