Week In Review: Moody Markets. 9 July 2021

Week In Review: Moody Markets

US equity indexes were up mildly on the week: DJIA +0.2%, S&P 500 +0.4%, NASDAQ +0.4 %. It was a back and forth week – Friday’s equity rally put US major indices in the green on the week after Thursday’s sell-off. The attention grabber this week was the fall in bond yields. Given the moves in bond yields, the Exante Data Team took a closer look:

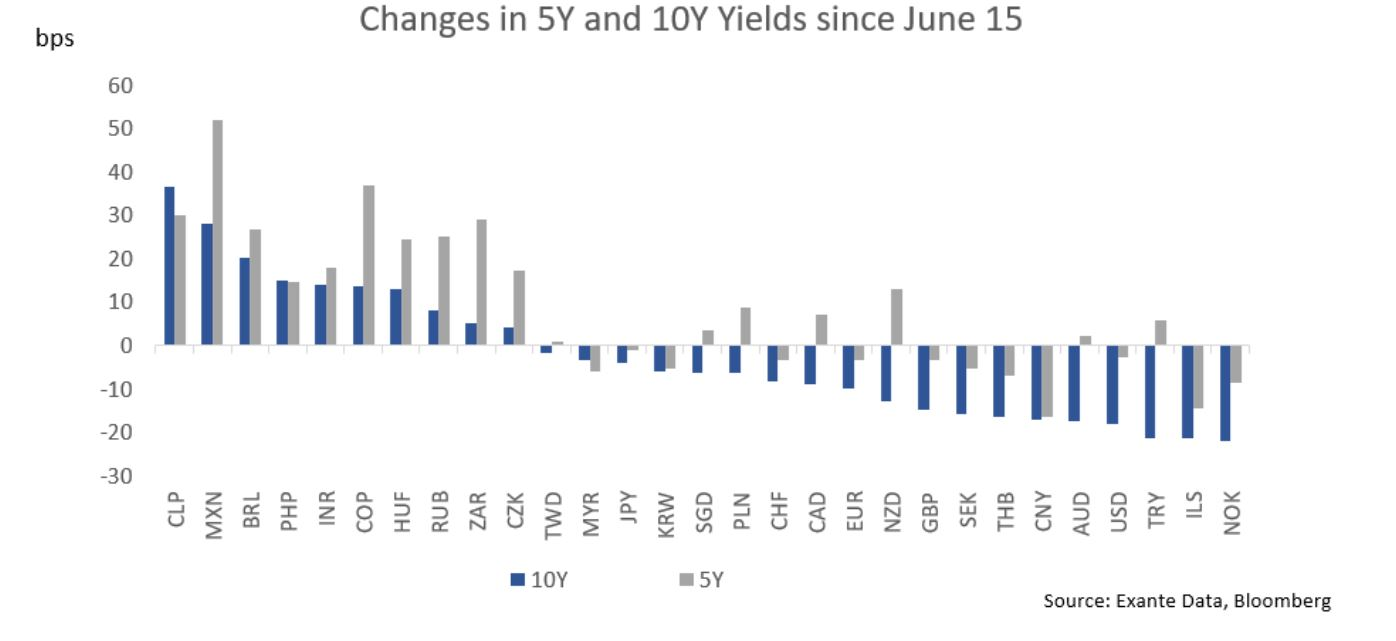

“Global bond markets have staged a dramatic rally over the past few weeks, with the new tone from the Fed coinciding with a rethink of global growth risks, inflation dynamics as well as a substantial shift in positioning. But there has also been meaningful divergence between countries.

The chart below looks at rate moves since June 15 (the day before the FOMC statement) and up to Thursday’s close, and we would observe the following:

We have seen 10Y yields decline broadly in G10 (and in China) and in G10-like EMs (Poland, Korea). But EM trends are different.

Short-end moves (illustrated with 5-year rates) are different. We have seen increases in some G10 countries in which central banks are turning more hawkish (New Zealand and Canada stand out); and in EM space short rates have increased substantially in a long list of countries as hiking cycles are getting under way.

It is also worth noting that the largest decline in 5Y rates in our sample has been in China.” Founder Jens Nordvig points out, “Since the Chinese yield curve is normally very low volatility (given more static monetary policy) this is highly unusual.”

Chart: The chart below looks at rate moves since June 15 (the day before the FOMC statement) and up to Thursday’s close.

USD Comment

USD strengthened since last Friday – see here. The DXY Index ranged 92.01 – 92.82, finishing the week at 92.10. EURUSD ranged 1.1893-1.1784. JPY gained vs USD on the week. USDJPY low was 109.54, which came on Thursday – the US equity sell-off day, so it was a classic safe haven gain. Looking at a wider group of pairs, USD outperformance is more pronounced, as risk aversion pushed EMFX lower. Importantly, in the 10Y tenor, US rate differentials do seem to strengthen broadly, supporting USD’s moves this week (chart below).

Chart: USD returns vs 10Y interest rate differentials

Covid-19 Update

In thinking about the Delta variant, it is important to examine the UK data as the delta variant has been circulating for longer there, allowing its effects to show up in the data both in terms of cases, hospitalizations and deaths. In the UK, cases are increasingly concentrated among the young, unvaccinated population. Meanwhile, fatality and hospitalization rates for people less than 20 years old are very close to flu levels at 0.01% and 0.4%, respectively. The combination of a higher prevalence among the young, and steady to declining severity among older groups, has lead to a continued decrease in national level hospitalization and fatality rates. The national fatality rate now stands at 0.28% (chart below). Case fatality rate (CFR) has dropped sharply since the spike in January, and at <0.3% is now approaching what you typically find for seasonal flu.

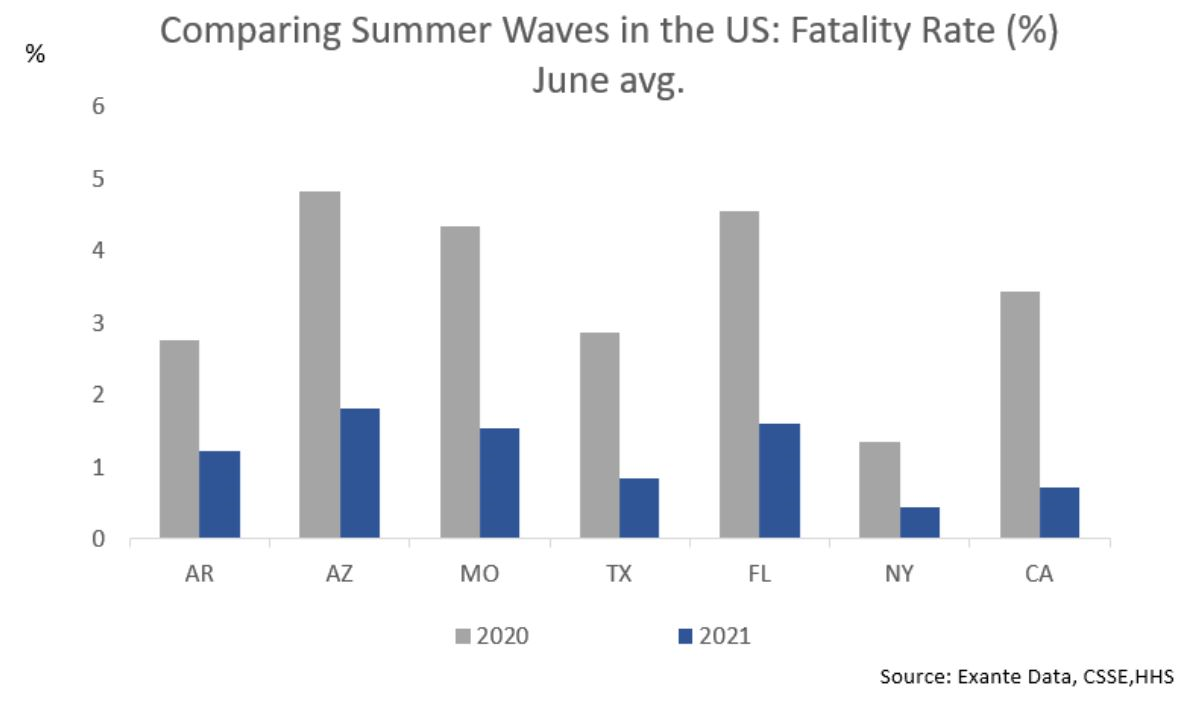

Turning to the US, early evidence points to lower CFRs; but we do not yet have a big delta spike on hand – see this chart. Case momentum seems to be worsening in a handful of states including Arizona and Missouri, but we have seen a similar pattern of falling fatality ratios. See here for counties more vaccinated and less vaccinated. In the current problem states and other big states, fatality ratios appear to be less than half as large as this time in 2020 and are hovering at 1.5% across a broad swath of the population (chart below).

Chart: Comparing Summer Waves in the US: Fatality Rates (%) June avg.

Exante Data Happenings & Media

We have introduced new charts on Twitter updated daily including:

G10 bond yields – 24 hour change

Daily returns of major cryptocurrencies and other global assets

Momentum of ETF flows by sector

Bloomberg users – you can view Exante Data tweets on the terminal. Users can type into the blue command line: TWEETS BY EXANTE <GO>. Alternatively, to add to Launchpad: 1. Run SOCI <GO> 2. Type into the orange box Exante 3. Select the handle at the bottom “TWT_EXANTEDATA” 4. Click the white LLP <GO> to Open in Launchpad to view in Launchpad mode 5. To save the search >>> Click Actions in the top red tool bar >> Save Search

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, Digital Currency Series, and/or our Covid-19 vaccine rollout tracking and Tourism Recovery tracking — please reach out to us here.