Week In Review: July 6, 2020

Week In Review

The week started off in risk-on mode on Monday as Shanghai Composite was up 5.71% in the Asia trading session. The positive equity index price action followed through to the European and New York trading sessions on the day. China equities remained in focus throughout the week — Shanghai Composite gained 16.5% in eight straight trading sessions through Thursday.

On the coronavirus front, the US reported a new single day case high and, very unfortunately, Covid-19 fatalities started to rise in Florida, Texas, California, and Arizona – though we note day-to-day data are volatile. In an effort to fight the rising case counts, states most impacted currently continue to “de-open” – Nevada announced bars would close again.

Back on the financial market front, a theme of this week was larger US companies announcing larger layoffs. UAL announced 36,000 employees could face layoffs on or around Oct. 1. Bloomberg reported WFC was readying thousands of jobs cuts for later this year. DAL Chief Executive Bastian warned on adding new flights due to continued growth of coronavirus and quarantine restrictions being imposed by northern US states. This seemed to have an equity market impact on Thursday — DJIA and S&P 500 finished lower on the day, VIX moved above 31.0 temporarily, and USD gained – the DXY Index backed off of 96.00 support.

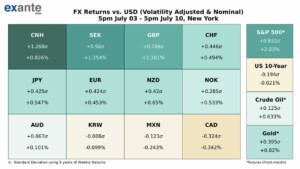

On the week, the three major US equity indexes finished in positive territory. The USD was broadly weaker (heatmap below). CNH appreciated with rising local equities and GBPUSD closed above 1.2600. There was commentary that GBP rallied vs USD on traders cutting shorts re positive Brexit news. But, we caution that this “news” looks more like unfortunate phrasing by an EU spokesperson who said “We are working hard to overcome significant divergences.” Meanwhile Chancellor Merkel said, “Progress in negotiations thus far has been slim, to put it diplomatically.”

Ahead: Amid rising Covid-19 cases in Florida, Disney World in Orlando starts the first phase of its reopening today. Earnings season gets underway next week. NFLX and major financials JPM, WFC and GS are among the first to report. Tier 1 economic data will be released across the G10. In addition, BoJ, BoC, ECB have monetary policy meetings.

Select economic data releases: Tuesday, July-14: German ZEW (Jul), US CPI (Jun), China Trade Balance (Jun). Wednesday, July-15: UK CPI (Jun); Canada: BoC Interest Rate Decision/Monetary Policy Report/Press Conference; Japan: BoJ Interest Rate Decision/Outlook Report; NZ CPI (Q2); Australia Employment (Jun); China Fixed Asset Investment (Jun); China Q2 GDP; China Retail Sales (Jun). Thursday, July-16: ECB Interest Rate Decision/Press Conference; US Retail Sales (Jun); US Philly Fed (Jul).

Covid-19 Growth: US State by State

The heatmap shows the trend of daily confirmed coronavirus cases among US states as of July-10. Daily case growth is trending above 2% for 20 states. Idaho’s case growth is now the nation’s most rapid. Florida and Arizona case count growth have slowed a bit. However, Florida’s ever increasing hit ratio is of concern, now trending upwards of 20% (right side bar). Arizona’s elevated hit ratio has declined over the past week. In South Carolina, the hit ratio mostly has continued to trend upwards since May despite daily case counts declining in the state. Follow our Twitter account (link at end of note) for updates on Covid-19 and other Alt-data charts.

On the Rise of Alt-Data

Exante Data was founded in 2016 based on the notion that data-driven investment processes would revolutionize the financial sector. In 2020, alternative data’s rise is accelerating dramatically, partly due to the COVID shock. Founder, Jens Nordvig, Grant Wilson, Web Begole, and Alex Etra wrote a public letter on this topic. Feedback is welcome.

Media:

- Head of Asia Pacific, Grant Wilson wrote an opinion column in the Australian Financial Review: Why alternative data is here to stay. Alternative data sources, typically the preserve of equity and commodity analysts, flew the coop through COVID-19, and are now a critical input to global macro.

- Senior Advisor, Brad Setser and Dylan Yalbir, a research associate at the Council on Foreign Relations wrote a blog for The Council on Foreign Relations: Slouching Toward Phase One. On current trends, goods exports to China will struggle to reach their 2017 level— there won’t be any big gains from the Phase One deal.