Week In Review: Competing Forces – 20 November 2020

This week brought more positive news on the vaccine front. On Monday, Moderna announced that its Phase 3 study of mRNA-1273, its vaccine candidate against COVID-19, “has met the statistical criteria pre-specified in the study protocol for efficacy, with a vaccine efficacy of 94.5%.” On Friday, Pfizer and BioNTech applied for an emergency use authorization from the FDA for their vaccine. Meanwhile, the CDC advised Americans not to travel for the upcoming Thanksgiving holiday as US Covid-19 cases continued to rise and more states implemented various restrictions (see coronavirus update section).

Due to the competing forces – on the positive side vaccine news and on the negative side rising US cases and restrictions – US equity indexes were mixed-to-down this week: DJIA -0.7%, S&P 500 -0.8%, NASDAQ +0.2%.

Not helping US equities later in the week, was the news on Thursday that Treasury Secretary Mnuchin declined to petition Congress for an extension of several emergency loan programs established jointly with the Federal Reserve. Our Head of Political Risk Analysis, Wouter Jongbloed noted that the spat between the Fed and Treasury “will probably be a temporary issue as legislative attention is about to shift to Congressional efforts to stave off a potential Government Shutdown on December 11 as well as the (slim) prospect of fiscal covid-relief action.”

Wouter goes on to say that “While any potential re-appropriation of the entire $455bn toward a bipartisan fiscal Covid-relief bill could help to bring Leader McConnell closer to Speaker Pelosi, the distance between them is still too far to be bridged by this infusion of cash. The gap between Senate Republicans and House Democrats currently not only stands at roughly at $1.5trn, but is also substantial in terms of policy preferences. Moreover, the release of these funds for re-appropriation by Congress opens an avenue for Leader McConnell to re-appropriate the funds as part of the Continuing Resolution bill that is being negotiated for December 11 and to subsequently claim those re-appropriations as ‘action’ on Covid-relief.”

Turning to negotiations across the pond, Wouter and our Senior Adviser Chris Marsh note that there could be a potential announcement on a Brexit deal next week. They write: “Despite the relative silence from the negotiation teams, what newsflow there has been these last days around Brexit have been positive, suggesting that both sides have begun to move (somewhat) on redlines.”

Ahead Next Week: Select economic releases: Sunday, Nov 22: NZ Retail Sales (Q3) Monday, Nov 23: EZ/Germany/UK PMIs (Nov), Tuesday, Nov 24: ECB Schnabel speech “New challenges on monetary policy strategy”, Release Consolidated Financial Statement of Eurosystem, Germany GDP (Q3), German Ifo (Nov), Fed’s Clarida discussion on “The Federal Reserve’s New Framework” at IMF Conference, RBNZ Gov Orr speaks, NZ Financial Stability Report. Wednesday, Nov 25: Chancellor Sunak–UK Spending Review, ECB Financial Stability Review, US PCE Prices (Oct), US Personal Income/Spending (Oct), US GDP (Q3P), US Initial Jobless Claims, U of Mich Sentiment (Nov), FOMC Meeting Minutes (Nov), NZ Trade Balance (Oct). Japan Foreign Bond Buying/Foreign Investments in Japanese stocks. Thursday, Nov 26: US Holiday-Thanksgiving, Riksbank policy decision, ECB Meeting Minutes Oct.

USD Comment

USD was lower this week – risk aversion driven by the US rise in Covid-19 cases and some US equity weakness did not boost it. However, the DXY Index remained in a relatively tight range 92.83-92.21. 92.00 remains support. Higher beta NOK, MXN, AUD, and NZD benefitted from the additional positive vaccine news. NZD continued its strong gains from last week, reaching a high of 0.6948. Sterling ranged 1.3169-1.3308, supported by the hope of a potential Brexit deal ahead. EURUSD ranged 1.1814-1.1886. EURUSD upside is capped due to the virus cases, restrictions, and the ECB signaling easing ahead in December. JPY strengthened vs USD on the week – the low was 103.66. You can see our USD November Seasonality from our proprietary FX factor model here. USD is weaker in November vs G10 FX.

Coronavirus Update

US: The US 3rd wave remains the near-term macro risk to watch, but an increasing number of states/cities are taking progressively stricter policy measures. Over the next few weeks we think it is critical to watch: a.) Can economically significant early third wave states in the Upper Midwest/Great Lakes (IL, WI, MI, OH) put in a peak following recent restrictions? b.) Will economically important coastal states (CA/NY) be able to arrest deteriorating trends before the situation becomes acute? This week, California announced a limited stay at home order and NYC closed schools for in-person learning. c.) Can Southern states with more favorable weather (FL/TX) avoid a 3rd wave?

We are looking for signs of slowing case momentum in the Upper Midwest – the region driving the early third wave case growth. The heatmap below shows Week over Week Covid-19 new case growth (rolling 7 day sums). While volatile, we’re seeing negative w/w growth in new cases (deceleration) in Illinois, Wisconsin, Idaho, and North and South Dakota. However, in the Northeast, Vermont is seeing positive w/w growth rates in new cases (acceleration) of 89%.

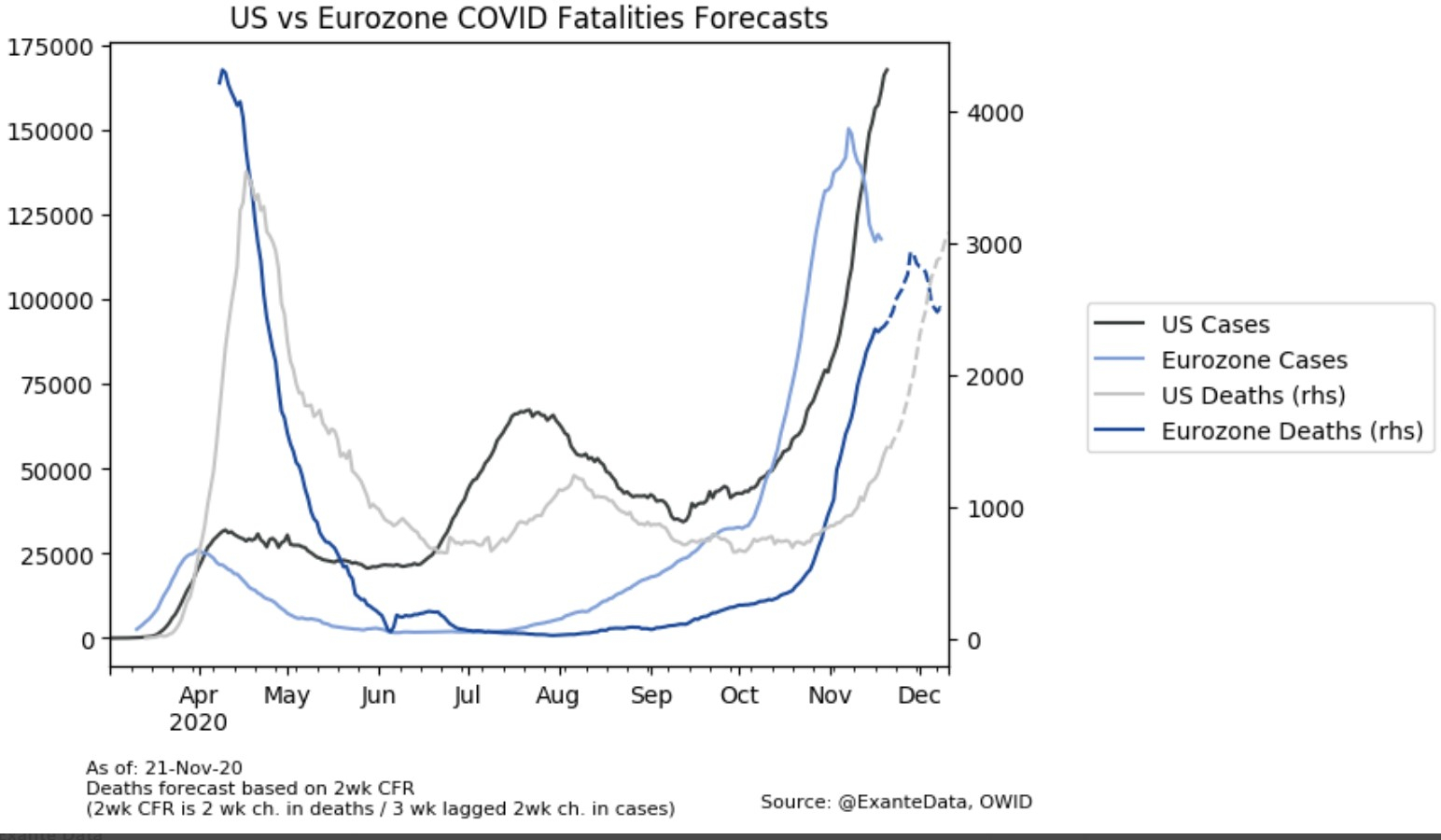

International: We continue to see signs that lockdowns and policy tightening are bringing case growth down in Western and (and to a lesser extent) Central Europe (chart below for Eurozone cases). Europe continues to improve with cases falling precipitously in Belgium, France, and the Netherlands. The turns in Spain, Germany, and the UK are more gradual but momentum is good overall. We forecast that Eurozone COVID deaths will peak at around 3,000 in early December if current trends persist (chart below).

On Covid-19, restrictions, and economic activity: We think the European data, starting with PMI indicators for November next week, are crucial to ‘calibrate’ how bad winter lockdowns will be for activity, not just in Europe, but in the Northern Hemisphere (since the European winter wave started earlier than the US one).

Outside of Europe: Brazil and Mexico are seeing momentum turn with cases now rising after improving for multiple weeks. In Asia, we are watching Japan whose third wave is now exceeding its prior two. Also, Korea is showing some signs of burgeoning case growth.

Media

Head of Asia Pacific Grant Wilson, has a new opinion column in the Australian Financial Review: The RBNZ Has Shredded Its Credibility. “The Reserve Bank of New Zealand has authored the most activist monetary policy on the planet, while ignoring the facts on the ground.”

If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, and/or Exante Data API — please reach out to us here.