Week In Review: Commodity Prices & Yield Spikes

Week In Review: Commodity Prices & Yield Spikes

US equity indexes were flat to down for the week: DJIA +0.1%, S&P 500 -0.7%, NASDAQ -1.6%.

The strength in commodity prices in recent sessions, particularly industrial metals, is supporting the terms of trade for commodity exporters. This is visible in our Trade Balance Nowcast (below) which shows the expected change in the current account balance to GDP over the next 12 months as a function of changes in commodity prices. Norway and Russia are getting a boost from energy prices. Chile, Australia, and to a lesser extent Brazil are benefitting from iron ore and copper prices. In Chile’s case, some of the support for CLP from copper prices may be partly offset by the central banks recent intervention program. But, the terms of trade remain very supportive.

Ahead Next Week: Select economic releases. Sunday, Feb 21: China PBOC Loan Prime Rate. Monday, Feb 22: German IFO (Feb), ECB Pres Lagarde speaks at the European Semester Conference, NZ Retail Sales (Q4). Tuesday, Feb 23: Japan holiday, UK Claimant Count (Jan), EZ CPI (Jan), Fed Chair Powell – Semi Annual Monetary Policy Report to Congress (Senate Committee on Banking, Housing, and Urban Affairs), BoC Gov Macklem speaks, RBNZ Monetary Policy Decision. Wednesday, Feb 24: Germany GDP Q4, Fed Chair Powell – Semi Annual Monetary Policy Report to Congress (House Committee on Financial Services), Fed Gov Brainard speaks on the Fed’s maximum employment mandate, Fed Vice Chair Clarida speaks on US economic outlook and monetary policy, US New Home Sales (Jan). Thursday, Feb 25: Mexico Q4 GDP, Mexico Current Account Q4, US Initial Jobless Claims, US Q4 GDP, NZ Trade Balance (Jan), Japan Retail Sales (Jan), Japan Foreign Bond Buying/Investments in Stocks, Australia Private Sector Credit (Jan). Friday, Feb 26: G20 Finance Ministers and Central Banking Governor Meeting – video conference, Switzerland GDP Q4, BoE Haldane recorded mini-speech on inflation outlook (to be published), ECB’s Schnabel speaks at the European Fiscal Board Annual Conference, Mexico Trade Balance (Jan), US Personal Income & Spending (Jan), US U of Michigan Consumer Sentiment (Feb).

USD Comment

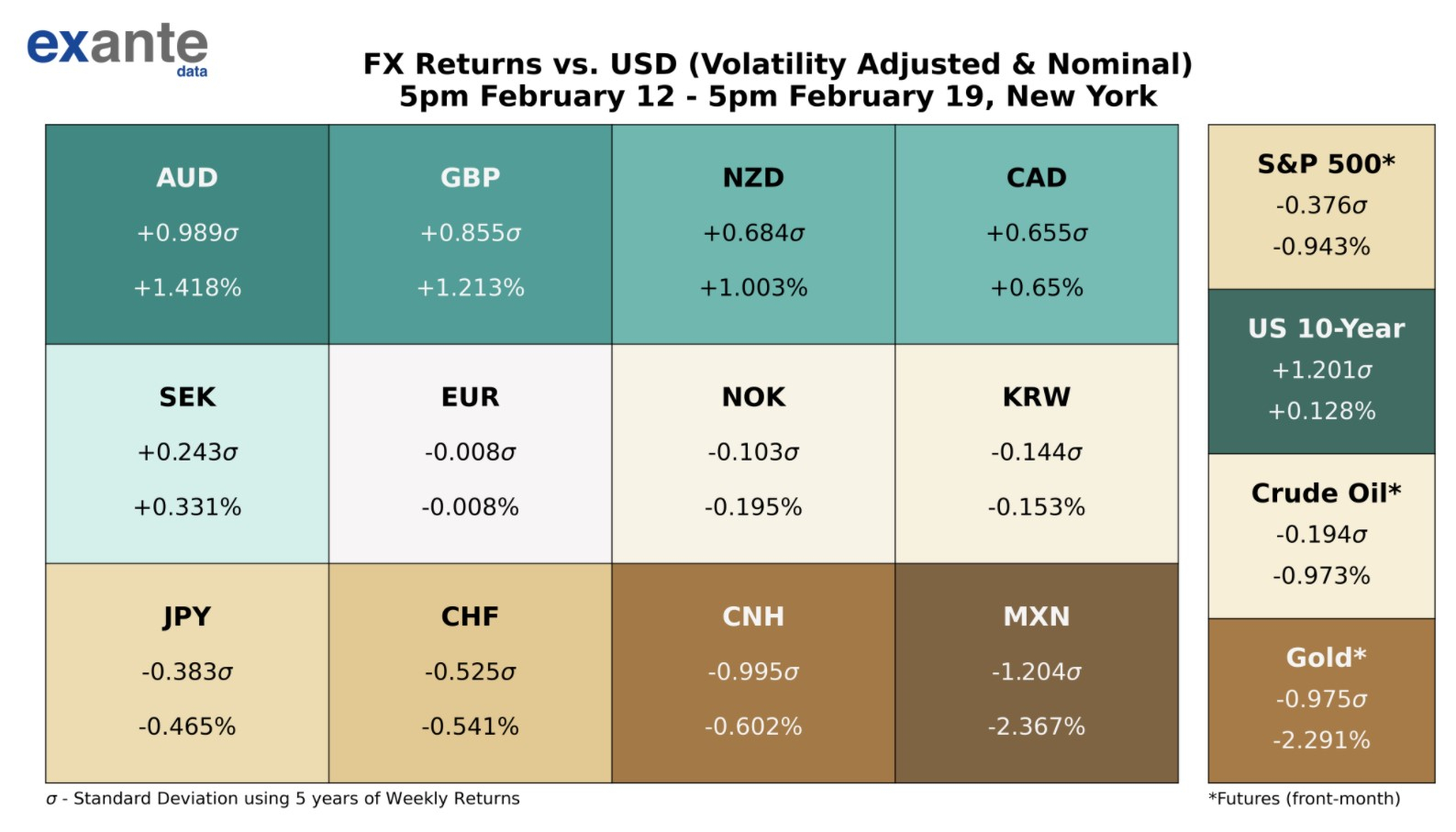

It is notable that the USD’s mixed to weak results for the past week came during a time that the US 10 year nominal yield rose 13 bps. We continue to think that the dollar will only receive limited support from yield spikes, as long as they are not visible in the short-end of the curve.

AUD, GBP, and NZD gained the most vs. USD on the week. GBPUSD rose above 1.4000 on Friday for the first time since April 2018. AUDUSD and NZDUSD rose to their highest levels, 0.7874 and 0.7313 respectively, since March 2018. The rise in commodity prices continues to support AUD especially and to a lesser extent NZD (see Trade Balance Nowcast chart above). Rounding out the Dollar Bloc, CAD is also strengthening vs USD. USDCAD broke below 1.2600 briefly on Friday – the low was 1.2594. The DXY Index remained above 90.00 support, ranging 90.11-91.05, and ending the week at 90.34. EURUSD, its largest component, ranged 1.2167-1.2042, ending the week at 1.2117. EURUSD has been in a rather narrow 1.2170-1.1960 range since the end of January. USDJPY continues to rise – the high was 106.20 this week.

Coronavirus Update

At Monday’s UK coronavirus press conference, UK PM Johnson announced that the UK had reached its initial goal of vaccinating the 15 million most vulnerable: “Today the national vaccination program continues to power past the target we set six weeks ago with more than 15 million people vaccinated across the UK…this is an unprecedented national achievement. But it is no moment to relax, in fact it is a moment to accelerate because the threat from this virus remains very real. Yes, its true, we vaccinated more than 90 percent of those aged over 70, but don’t forget, that 60 percent of hospital patients with Covid are under 70…The level of infection remains very high with still more people in the hospital today than at the peak last April.” See daily Covid cases for the most affected countries, including the UK, here. On Monday, PM Johnson is expected to announce his “roadmap” to ending lockdown/reopening – this will be closely watched.

Turning to the US, Moderna recently announced it plans to increase the pace of deliveries in the US. According to Moderna it has “moved forward delivery of its second 100 million doses by one month, from end of June 2021 to end of May 2021. It has moved forward delivery of its third 100 million doses by two months, from end of September 2021 to end of July 2021….the monthly doses released to the US Government are expected to double again by April, with an expected average of 30-35 million doses per month for February and March, and 40-50 million doses a month from April through the end of July.” Moderna notes, “All U.S. supply comes from Moderna’s dedicated supply chain in the U.S. Supply to locations outside of the U.S. comes from dedicated supply points based outside of the U.S.”

Charts: The US daily number of doses administered was 1.8mn on Friday – February 19th (chart left side). CDC data shows the 7dma falling slightly to just above 1.5mn doses per day as of February 14 – perhaps winter weather disruptions are impacting the US vaccine numbers. The chart on the right shows cumulative doses administered per 100,000 people by country excluding Israel and UAE. The UK leads, with the US next and a sharp rise in Chile.

Exante Data Happenings & Media

Senior Strategist Alex Etra has a new blog out on our Substack – China’s Balance of Payments (Part II): Rising Overseas Bank Lending In Lieu of FX Reserve Accumulation. This is a follow-on from his Part I blog: China’s Balance of Payments: From the Trade War to a “Positive” COVID Shock. “In Part I, we discussed the remarkable resilience in China’s external balance in 2020. Here we focus on the capital outflows that are the counterpart to the current account surplus and bond inflows.”

Head of Asia Pacific, Grant Wilson, spoke to CNBC International about Facebook’s decision to pull news publishers’ access to its platform in Australia.

Encore release: Grant Wilson, and Exante Data were featured in the reporting work of CNBC International’s Joumanna Bercetche last week. Bercetche reported on Why central banks want to launch digital currencies. “Interest in bitcoin and other cryptocurrencies may be surging, but central banks don’t want to be left behind by financial innovation. In fact, more than 80% are examining how to launch digital versions of their own currencies.” Watch the CNBC Reports video here. Read the accompanying article here.

How to Reach Us:

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, our Digital Currency Series, and/or our Covid research — please reach out to us here.

- Our Substack is public – Join us in discussing and debating large, macroeconomic topics – Subscribe here.