Week In Review: Choppy Market Waters. 16 July 2021

Week In Review: Choppy Market Waters

US equity indexes were lower on the week: DJIA -0.5%, S&P 500 -1.0%, NASDAQ -1.9%. It was a choppy trading week as the market focused on the spread of the Covid-19 Delta variant, and considered both the jump in the June CPI and the University of Michigan’s lower than expected read for July preliminary consumer sentiment.

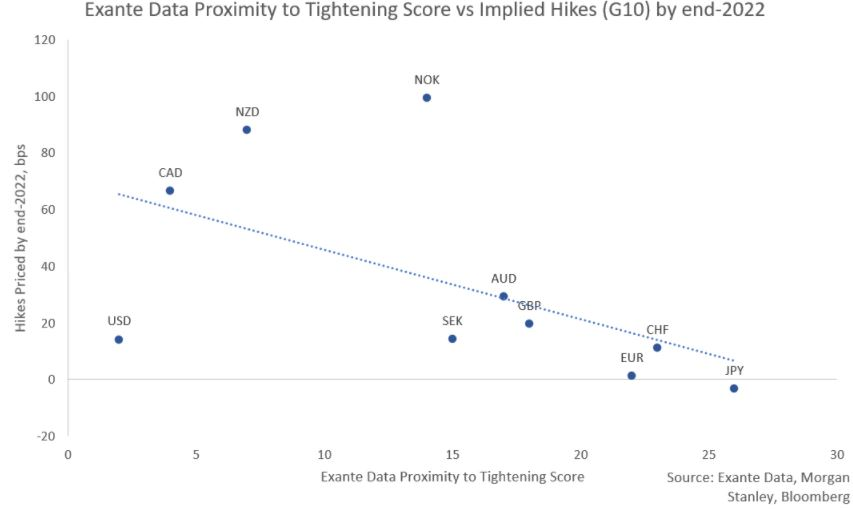

Not everybody is like the Fed: Back in mid-June, we outlined a simple framework for ‘proximity to tightening’. The Fed has adopted a very aggressive monetary stance, via its average inflation targeting (AIT) approach. (Post the June FOMC, the Fed is still moving more gradually than others even if not as gradually as previously thought.) But not everybody is like the Fed. Few central banks are going to actively push for a sustained overshoot of targets. Instead, many central banks will respond in more orthodox ways to inflation pressure, when it arrives.

The Exante Data Team notes: “Recently, we have seen fairly dramatic moves in bond markets, led by large declines in long-dated US yields (and declining Chinese yields). While market sentiment has shifted fairly violently (including in risk asset space), we do not think the overall macro outlook is dramatically altered. First, we continue to observe upside inflation surprises in economies that are reopening. Second, while there is currently elevated concerns about the rapid delta outbreaks around the world, we still believe that the ‘reverse cliff effect’ for vaccine supply will improve the picture notably during H2, supporting global growth. Third, while some PMI indicators have shifted down (such as the latest US and Chinese PMIs), we still think leading indicators point to strong global growth and will stay elevated in coming months (supported by excess savings and pent up demand). All told, we still think there are a fair few central banks that will push ahead with monetary policy normalization plans in coming months.”

Note: The charts below are through July 9, 2021. Even though they are not the most up to date, this exercise is still instructive.

Charts: G10 and EM – Exante Data proprietary Proximity to tightening score vs Implied hikes by end-2022.

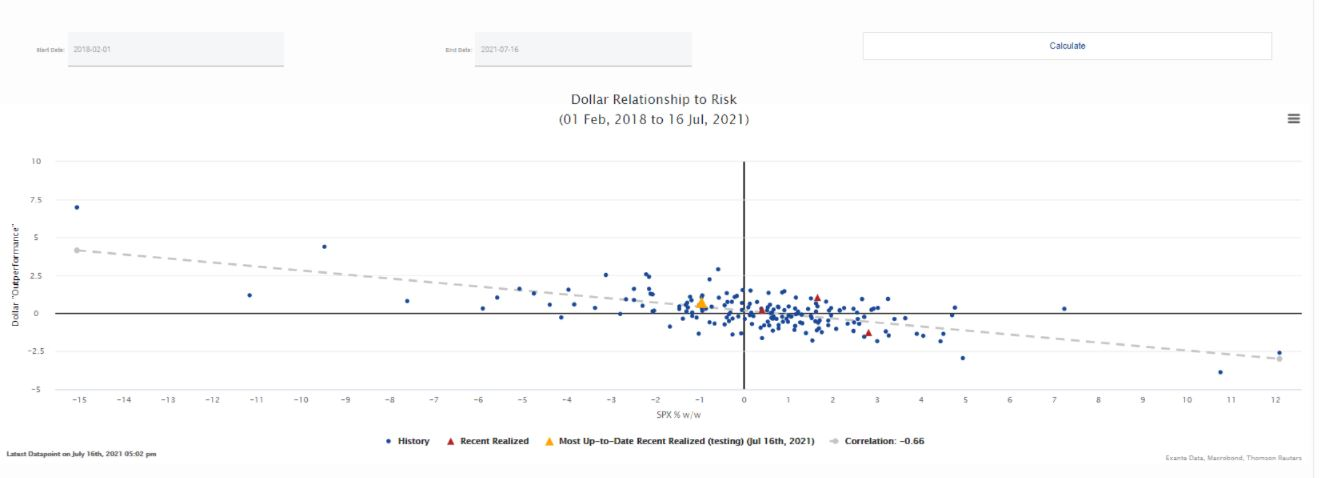

USD Comment

USD strengthened on the week, rising as US equities fell (see chart below – yellow triangle). The DXY Index ranged 92.08-92.85. EURUSD dipped below 1.1800, the low was 1.1772, but ended the week at 1.1804. Higher beta currencies NOK, CAD, SEK, and AUD declined the most against the USD this week. Australia’s Covid outbreak also weighed on AUD. AUDNZD moved lower as the RBNZ announced it will end its bond buying under the Large Scale Asset Purchase Program by July 23rd. AUDNZD started the week around 1.0733 and ended the week at 1.0555.

Chart: USD Relationship to Risk

Covid-19 Update: A look at the US

Earlier this week, Senior Advisor Amelia Bourdeau was on TD Ameritrade talking about the Covid-19 Delta variant. You can watch the interview here. In the US, Covid-19 cases have risen from a very low level – see this chart. Week on week case growth in the US by state is shown here – note, lots of red (high growth) suddenly across the US, as delta drives cases. Hospitalizations have ticked up but remain low compared to other periods during the pandemic.

Senior Strategist Alex Etra took a look at US vaccinations: ‘Vaccination rates are higher among people who are older. Though that is partly due to vaccines being offered to older people first, the increase in vaccination coverage appears to slow down at a lower level of vaccination among younger people. Among those over 75, the increase in the vaccination rate began to slow down when 70% had received at least one dose. Among the 25-39 year olds, however, the increase in vaccination began to slow down much earlier, once around 40% of people had received at least one dose (chart below). As vaccine supply is not a constraining factor in the US, this implies that vaccine hesitancy is higher among younger people.”

Chart: US: Share of Age Cohort Fully Vaccinated

The chart below shows growth in COVID cases vs level of vaccination, by US state.

Exante Data Happenings & Media

We have introduced new charts on Twitter updated daily including:

G10 bond yields – 24 hour change

Daily returns of major cryptocurrencies and other global assets

Momentum of ETF flows by sector

Follow us on Twitter for daily chart updates.

Bloomberg users – you can view Exante Data tweets on the terminal. Users can type into the blue command line: TWEETS BY EXANTE <GO>. Alternatively, to add to Launchpad: 1. Run SOCI <GO> 2. Type into the orange box Exante 3. Select the handle at the bottom “TWT_EXANTEDATA” 4. Click the white LLP <GO> to Open in Launchpad to view in Launchpad mode 5. To save the search >>> Click Actions in the top red tool bar >> Save Search

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, Digital Currency Series, and/or our Covid-19 vaccine rollout tracking and Tourism Recovery tracking — please reach out to us here.