Week In Review: Catching Up. 23 April 2021

Week In Review: Catching Up

US equity indexes were slightly lower on the week: DJIA -0.5%, S&P 500 -0.1%, NASDAQ -0.3%. US equity indexes were slightly off on the week, rattled by President Biden’s proposal to hike the capital gains tax rate.

US equities have enjoyed a stellar run since the pandemic panic just over a year ago. Work by Senior Strategist Alex Etra and Exante Data team members shows that one under-appreciated aspect of this strong performance is the support provided by foreign investors; indeed, we find that any way you slice fund flow data, there has been a dramatic acceleration in equity inflows to the US in the past year. This is confirmed in official Flow of Funds and BoP data; the 2.7% of GDP inflow in 2020 has only been surpassed twice in history (in March 2015 and mid-2009.)

Moreover, our high frequency proxies for the BoP such as the TIC data suggest these trends have persisted so far in 2021, with estimated foreign equity inflows in January and February of $152bn and $146bn respectively.

Turning to central banks, here are Senior Advisor Chris Marsh’s notes on ECB: “The ECB policy meeting was relatively uneventful, with Reuters reporting afterward that Governing Council agreed not to discuss the June policy decision until the new forecasts are available. In this way, President Lagarde was able to claim in the press conference that tapering of PEPP was not raised at the meeting; focus now turns to the revised staff forecasts and policy meeting in 7 weeks. Looking to the Strategy Review, President Lagarde noted that they hope to report on or before the Fall this year, and that they are considering various proposals including Yield Curve Control. This is the first time this option has been acknowledged as a possibility among several under consideration. The Strategy Review will be a crucial development later this year.”

In other central bank news, the Bank of Canada at Wednesday’s policy decision announcement and MPR release, upgraded its growth outlook, scaled back its bond-purchase program, and moved-forward its expectation for when economic conditions would warrant a higher policy rate. This makes the BoC the first major economy to reduce its emergency levels of monetary stimulus.

Ahead Next Week: Select economic releases. Next week sees monetary policy decisions by: FOMC, Riksbank and the BoJ.

USD Comment

The dollar underperformed for the fourth consecutive week this week. The underperformance is not due to risk-seeking sentiment as equities were essentially flat on the week. The dollar’s performance this week (yellow triangle) was indeed 70bps below what would be expected. Further, note that the prior three data points (red triangles) were all significantly lower than would be be expected given the equity signal. We view this as evidence that more pronounced USD weakness can kick in when positions are cleaner.

Coronavirus Update: Catching Up

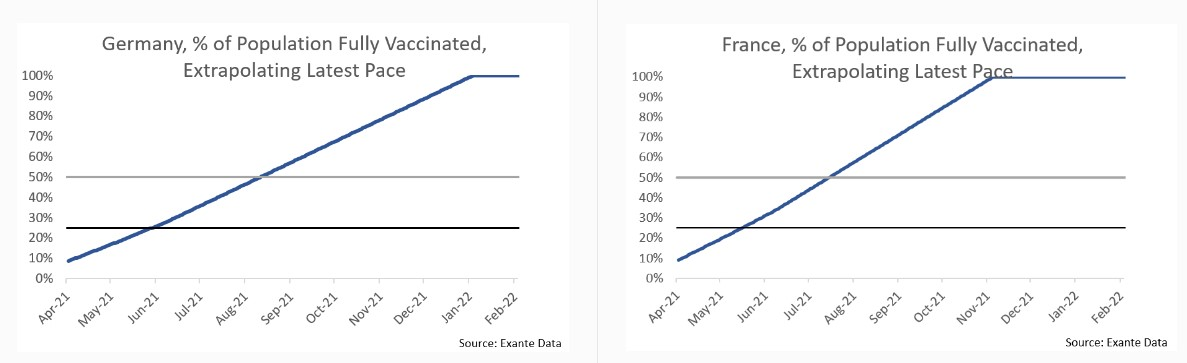

Charts: Germany & France, percentage of population fully vaccinated, extrapolating latest pace and noting 25% and 50%.

Exante Data Happenings & Media

Head of Asia Pacific, Grant Wilson, released a new opinion column in The Australia Financial Review. The good, bad and ugly of crypto. “Crypto has entered into a manic phase. Not everything is bad, but a lot of what is happening now is downright ugly. Crypto can and will have to do better than this.”

Encore: Founder Jens Nordvig joined Raoul Pal and Real Vision for a deep dive into the global macro outlook. The full interview is here, but you have to be a Real Vision subscriber to view. Clips from the interview are here and here.

Get an short introduction to Exante Data and the Exante Humans behind our Substack blogs – here.

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, our Digital Currency Series, and/or our Covid research — please reach out to us here