New Analytics: Exante Trade NowCast for 25+ Economies

Dear friends and colleagues,

We are constantly adding new functionality to the Global Flow Analysis (GFA) platform. Two weeks ago we announced a new sophisticated model for predicting CTA flows (let us know if you want a recap). And this week, we are announcing that we have added a Trade Balance Nowcast function to GFA.

The chart below is taken from the new section on the site and shows a cross sectional comparison of the estimated impact of current commodity prices (relative to the prior 12-months) on countries’ current account balances including a decomposition by commodity. Norway shows a very negative projected change (to the right), due to lower natural gas prices. To the left, Hungary and India stand to benefit meaningfully from recent lower oil and coal prices.

Below we provide some background on this new tool, but if you would like more details please reach out to us (info@exantedata.com) and request a copy of our primer including some selected case studies.

Introducing Exante Data’s Commodity Trade Balance Nowcast Model

Exante Data already incorporates ToT dynamics into our FX factor model (via an oil price proxy) and in our TEER exchange rate valuation models (via widely used terms of trade indices).

However, our past approach was not fully satisfying in terms of capturing the impact of non-oil trade on countries’ commodity balances.

Further, traditional terms of trade indices are often opaque in their construction, unintuitive to interpret and inefficient from a forecasting perspective.

In an effort to improve our modelling of ToT dynamics (and to capture volume trends) we have constructed a commodity trade balance nowcast for more than 20 countries that captures the impact of real-time changes in commodity prices on countries’ trade balances in nominal/notional terms (i.e. billions of dollars) and in percent of GDP.

In short, the model is designed to isolate and quantify the impact of changes in commodity prices on countries’ external balances with model outputs expressed in a more intuitive nominal “flow” space.

We think this has several potential advantages over standard and widely used terms of trade indices and is more intuitive.

First, most normal ToT variables (eg an export price index over import price index) are not conceptually set up for currency forecasting. For instance, many standard indices do not account for countries net trade and/or place equal weights on changes in import and export prices when in fact the relative magnitude of imports and exports varies across countries. Second indices typically have fixed-weights that are adjusted infrequently rather than time-varying weights which adjust more dynamically to changes in the composition of countries’ trade.

By constructing our measure in a nominal flow space we think our approach is more intuitive and is more easily integrated with other aspects of our analysis of BoP dynamics, capital flows and FX performance.

The model incorporates the most up to date balance of payments, trade and commodity price data and is updated daily and is now available here as part of our Global Flow Analytics (GFA) platform.

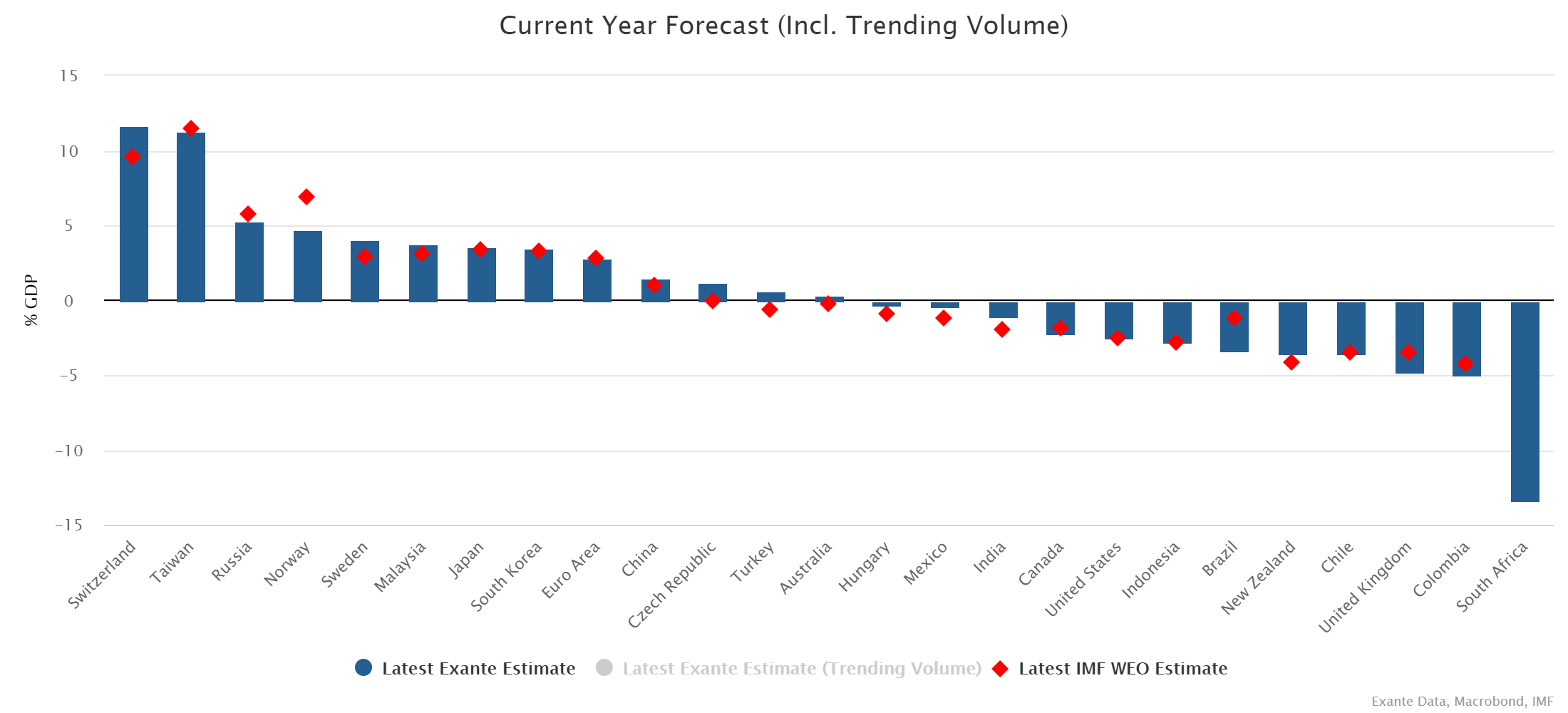

In addition to the cross-sectional views in the chart above, you can find country-by-country time-series estimates including one-year ahead forecasts and a detailed decomposition by commodity for each country assuming either constant or trending commodity trade volumes.

Finally, for quick reference, the latest available Exante estimate of each country’s current account/GDP for the current calendar year is plotted against the latest available estimate from the IMF’s World Economic Outlook.

Over time, we plan to continue to refine the model including with the addition of more countries, more detailed country-by-country trade data, more timely commodity price information, as well as via in depth analysis of the linkages between the commodity trade balance and other line items of the current account.

In addition, we will also incorporate our trade balance nowcast factors as defaults into our FX Factor models.

Let us know if you have any questions or feedback.

Jens Nordvig, Founder & CEO

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve macro strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.