Catching Up with Exante Data

It is good to be back in communication. Our Week In Review note has been on hiatus. We like to change things up, and are working on new projects. We continue to consider how best to communicate with our followers and show a bit of our work that we think could be helpful. If you have suggestions, you can reply on Twitter to the post with this note in it.

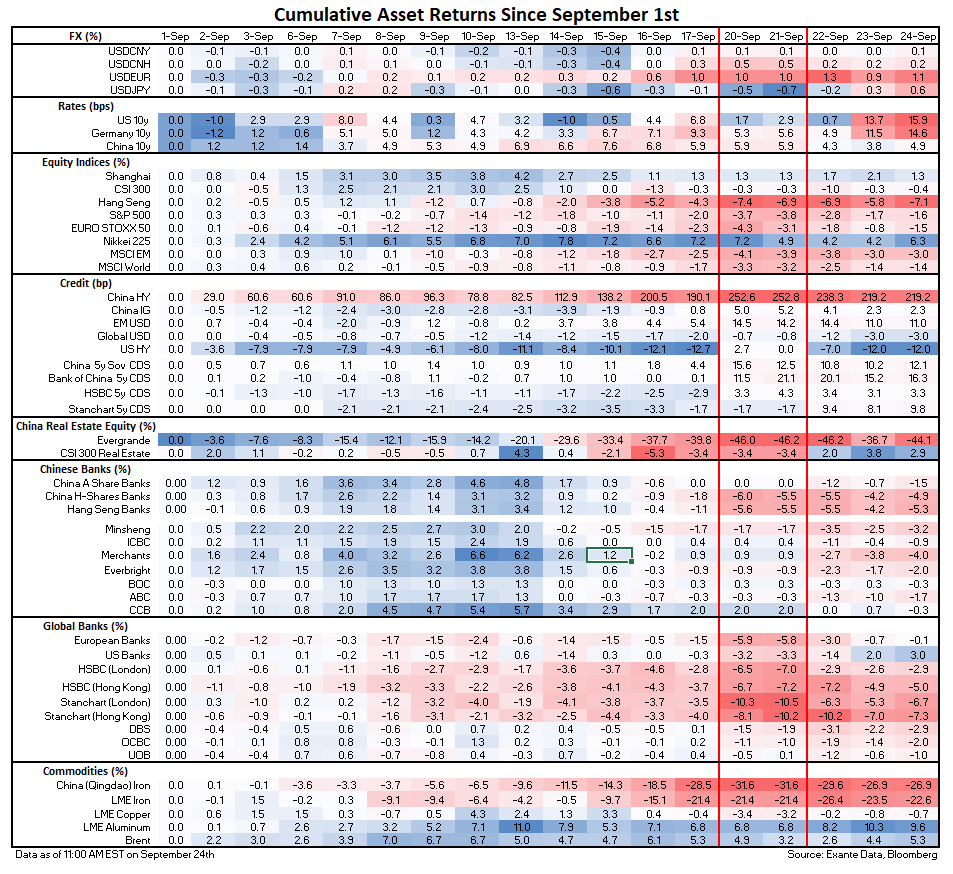

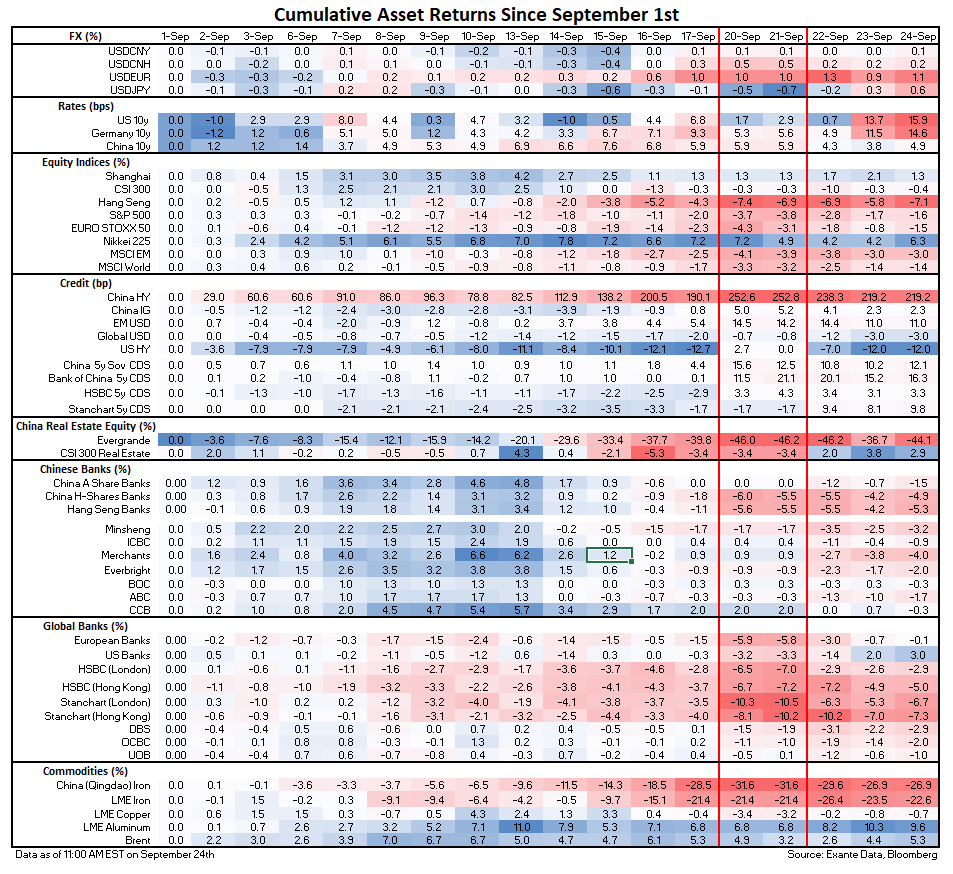

Recently, we launched a publication for clients that tracks China contagion – updates on high-frequency data on Chinese real estate, PBOC policy interventions, market signals as well as global spill-over mechanisms. Below is a table that provides an overview of Chinese and global market prices that are relevant to the Chinese real estate situation.

In the table, red cells are highlighting pockets of contagion. Around Sep 20, we had contagion to a long list of global assets. But by the end of the week many assets had recovered, and the contagion effects are now pretty isolated in assets that are more directly linked to Chinese real estate such as HY Credit indices, iron ore and specific local banks.

Table: China Contagion Summary

Founder Jens Nordvig released a series of tweet threads, which received millions of views, on Evergrande. We turned them into blog posts:

Jens also gave a one hour interview to Real Vision on Evergrande. He talked: what the data are indicating about contagion and explored why it has been the Hong Kong dollar, rather than the Yuan, making the biggest moves on a volatility-adjusted basis. One has to be a Real Vision subscriber to view the interview – the link is

here (in the event you are one!).

Exante Data Media

Head of Asia Pacific, Grant Wilson, writes regularly for the Australia Financial Review. His AFR page is

here. Grant’s latest column is

Snubbing China on trade is a strategic mistake. “Comments on Friday by Trade Minister Dan Tehan regarding China’s accession to the Indo-Pacific region trade group were a serious fumble.”

In our most recent

Substack (Sept 13), Senior Advisor Chris Marsh looked at Bank of England balance sheet shrinkage (Part 1). “The Bank of England announced in August the intention to undertake balance sheet shrinkage as part of the next tightening cycle. But how fast might this normalization be? Under passive balance sheet rolloff, we estimate that—once it begins—roughly 8 years will be needed to unwind the last 18 months of pandemic-related expansion. But is this fast enough for the MPC? In any case, when might the Bank incur losses on monetary income as rates rise, triggering the secretive HM Treasury indemnity? Bank Rate above 114bps would imply zero net monetary income over the life of the program, while above 170bps would deliver negative income already over the next 3 years.”