Week In Review: Fun Summer? 28 May 2021

Week In Review: Fun Summer?

US equity indexes were up on the week: DJIA +0.9%, S&P 500 +1.2%, NASDAQ +2.1%. The Dow and S&P 500 ended the month higher, while NASDAQ had a 1.5% decline, breaking a 6-month streak of gains.

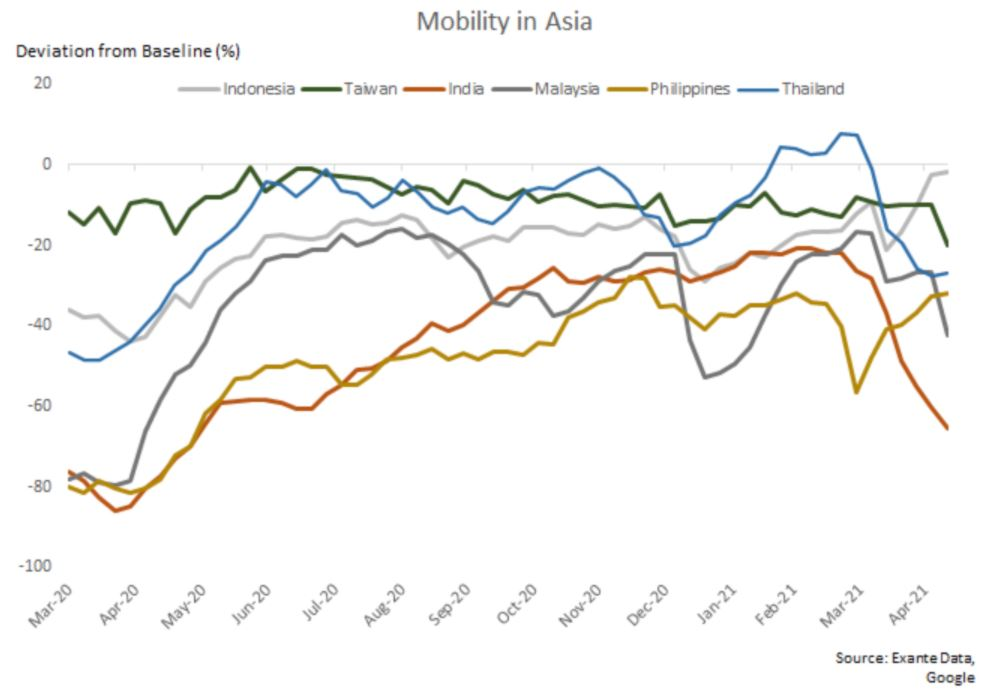

Fun Summer? The virus was the most important driver (along with stimulus) in 2020, and 2021 will be dominated by reopening trends. While the focus on the virus is receding in the US as cases plummet, there are still large parts of the world in which mobility is severely depressed due to governmental restrictions and self-policing. Taking a look at mobility, the US reopening is progressing with 100% normalization of policies in most states by July. Europe’s reopening is in motion too, but the process will be felt more in Q3 than in Q2. Recently, the EU and UK’s retail and recreation mobility have caught up with that of Japan, whose mobility in that category is trending down (top chart). In EM space, rolling reopening over the next 3-6 months will be supportive of growth there, especially when tourism also kicks in again (although that is dependent on policy choices, and harder to predict). However, currently, there is potential for further mobility improvement in Latam and EMEA, while Asia is on a deteriorating path (see bottom chart below for Asia). Unsurprisingly, in the region, India stands out with severely depressed mobility. But other countries there are on a downward path too. (See Most Depressed Traffic Congestion in global top 30 cities here. India, Taiwan, and Thailand in focus).

Ahead, our basic view is that an expanding list of countries will soon look ‘Israel-like’ in their COVID trajectory based on the vaccine “reverse cliff” (see WIR May 7th, Covid section). Specifically, by Q3, enough vaccine doses will have been delivered in a long list of countries for it to make a difference (we use a ‘low’ threshold of 60/100, as the initial milestone, based on the experience from most countries reaching such rates). All told, we think there is potential for notable improvement in mobility in a long list of countries in Q3, with positive effects on PMIs and growth numbers broadly.

Charts: Mobility – Retail & Recreation: G4 (top) and Asia (bottom).

Ahead Next Week: Select economic releases. Next week sees the RBA and RBI monetary policy decisions, US May Payrolls, Canada May Employment, Australia/Canada/Thailand/

Sunday, May 30: Japan Retail Sales (Apr), Japan IP (May), China Mfg/Non-Mfg PMIs (May), Australia Private Sector Credit (Apr).

Monday, May 31: Holiday US/UK, OECD releases its Economic Outlook, Germany CPI (May), Turkey GDP (Q1), Thailand Current Account (Apr), South Africa Trade Balance (Apr), Canada Current Account (Q1), Korea Trade Balance (May), Australia Current Account (Q1), China Caixin Mfg PMI (May), RBA Monetary Policy Decision.

Tuesday, June 1: Fed’s Brainard at Econ Club NY on Economic and Monetary Policy Outlook, BoE’s Bailey at Reuters Events Global Responsible Business 2021 ‘Building a Finance System Fit for a Clean, Resilient and Just Future’, Germany Retail Sales (Apr), Germany/EZ/Norway Mfg PMIs (May), Switzerland GDP (Q1), EZ CPI (May), Brazil GDP (Q1), Canada GDP (Q1), US ISM Mfg (May), Brazil Trade Balance (May), Korea CPI (May), Australia GDP (Q1).

Wednesday, June 2: Norway Current Account (Q1), US Fed’s Beige Book, Australia Trade Balance (Apr), Australia Retail Sales (April), China Caixin PMI (May).

Thursday, June 3: Holiday Brazil/Thailand. BoE’s Bailey at BIS’s Greening the Financial System Conference speaks on ‘How in practice can the financial sector take immediate action against climate change-related risks’, Turkey CPI (May), UK/EZ Services PMIs (May), US ADP Employment (May), US ISM Non-Mfg (May), Thailand CPI (May).

Friday, June 4: RBI monetary policy decision, Fed’s Powell at Green Swan 2021 Global Virtual Conference on central banks and climate change, G-7 Finance Ministers & Central Bank Governors meet in London, Sweden Current Account (May), US Payrolls (May), Canada Employment (May), Canada Ivey PMI (May).

USD Comment

USD was flat to slightly down on the week. The USD behaved in line with risk-assets as well, with the yellow triangle on the right (representing this week) remaining close to the gray line (chart below). The DXY Index had a narrow range of 89.53 – 90.43 and ended the week above 90.00 support. EURUSD, the DXY’s largest component, was also in a tight range of 1.2264-1.2134. The USD weakened the most vs. NZD, KRW, TWD and CNY. USD gained vs. JPY, which continues to trade poorly given the recent decline in US yields.

USDCNY broke downside 6.400 this week. We released a new Substack by Senior Strategist Alex Etra titled: China BoP (Part III): Back in the Manipulation Game? Alex talks China FX policy: “With USDCNY moving below 6.40 and a flurry of commentary from Chinese officials on the exchange rate, it is a crucial time to evaluate PBOC FX policy. While ‘words’ matter as signaling devises, we pay very close attention to both the ‘direct’ intervention by the central bank and indirect intervention via the banking system.” Alex’s charts and conclusions are in the full Substack blog linked above. While we cannot show all the details of the most up-to-date readings on Exante Data’s proprietary real time intervention model, we provide some hints.

Chart: USD relationship to risk

Covid-19 Vaccine Update

The US vaccination rate is trending down, however, this week, the US reached a milestone – it has 50% of its adult population fully vaccinated (story here, CDC stats here). The pace of vaccinations in the EU is stable, though it remains high at around 0.7-0.8 doses per 100 people per day. Strategist Martin Rasmussen notes, “Italy and Germany have seen a marginal increase in doses administered, though the speed has fallen in France and Spain.”

China now administers 1.2 doses per 100 people each day. Ex-China EMs and frontier markets continue to vaccinate at a slow speed, though the roll-outs in major EMs has begun to increase slowly. Looking at Covid case momentum, Asia is the laggard in terms of global Covid trends, with Malaysia concerning (see charts Asia and global).

Chart: Select Countries – Daily New Vaccine Doses Administered per 100k people (7d ave)

Exante Data Happenings & Media

Alex Etra published a Substack blog on China FX policy (mentioned above).

In this short video, Alex and Senior Advisor Amelia Bourdeau talk about his Substack – RMB appreciation, muddled communication from China officials, Exante Data’s daily real-time PBOC intervention model, and state banks pushing back at 6.40 level.

Head of Asia Pacific, Grant Wilson, has a new opinion column in The Australian Financial Review: The dominance of bitcoin is ending. “The greening of crypto is belatedly under way, and will expose bitcoin maximalists to an overdue reckoning.”

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, Digital Currency Series, and/or our Covid / vaccine rollout research — please reach out to us here.